Executive Summary: Market Inflection Point

India’s hematology diagnostics market is experiencing accelerated growth, expanding from USD 420 million in 2024 to USD 720 million in 2035, representing a compound annual growth rate of 5.0%. Beyond this, India’s overall diagnostic industry reaches USD 4-5 billion in scale with annual growth of 13-14%, yet the organized segment represents only 25% (labs accounting for 15%, radiology for 10%).

The core opportunity for importers lies in India’s high import dependency for medical devices at 70%, meaning that despite “Make in India” initiatives, substantial imports remain necessary. U.S. medical device exports to India surged 66.3% in fiscal year 2024, jumping from USD 872 million in FY2020 to USD 1.45 billion. Simultaneously, government infrastructure investments and explosive growth of diagnostic centers in tier-2 and tier-3 cities create a strategic 5-7 year window for importers to establish market presence before domestic manufacturers consolidate their positions.

Government Healthcare Modernization: Demand Catalyst

Ayushman Bharat Health Infrastructure Mission and NITI Aayog Diagnostics Push

India’s government launched the Pradhan Mantri Ayushman Bharat Health Infrastructure Mission with an investment scale of INR 64,180 crore (2021-2026), establishing 730 Integrated District Public Health Laboratories and 3,000 Block Public Health Units nationwide. These facilities serve over 500 million beneficiaries, with each family receiving approximately INR 500,000 (approximately USD 6,000) in medical coverage.

The NITI Aayog-supported aspirational district program covers 50%+ of infrastructure-deficient regions, which are now serviced by organized diagnostic chains. By 2026, an estimated 25,000 health facilities are expected to be equipped with solar-battery systems, which is crucial for distributed diagnostic equipment deployment.

Market Segmentation: Growth Concentration in Tier-2 and Tier-3 Cities

Tier-2 and Tier-3 Cities: 25% CAGR, Representing 40% of Market Revenue with Rapid Expansion

Data demonstrates that tier-2 and tier-3 cities grow at a 25% compound annual growth rate, compared to only 10% in metropolitan areas. Tier-2 and tier-3 cities currently contribute approximately 40% of diagnostic industry revenue, projected to reach a 50:50 split by 2027-2028.

India’s 70% population residing in tier-2, tier-3 cities and villages faces diagnostic service supply that is less than half that of major metropolitan areas. This supply gap creates commercial opportunities: Dr. Lal PathLabs (DLPL) added 18 diagnostic laboratories and 900 collection centers in FY2025, with plans to add 15-20 more laboratories and 700-800 sampling points in the following year.

Metropolis Healthcare operates over 700 service points across seven states and plans to expand to 1,000 towns within 12-18 months, with tier-2 and tier-3 cities already accounting for 34% of revenue in H1 FY2024, growing 23% year-over-year. Redcliffe Labs pursues a more aggressive strategy, with 80% of its network in smaller cities and 60% of revenue from tier-2 and tier-3 cities.

Demand Characteristics Across Healthcare Facility Types

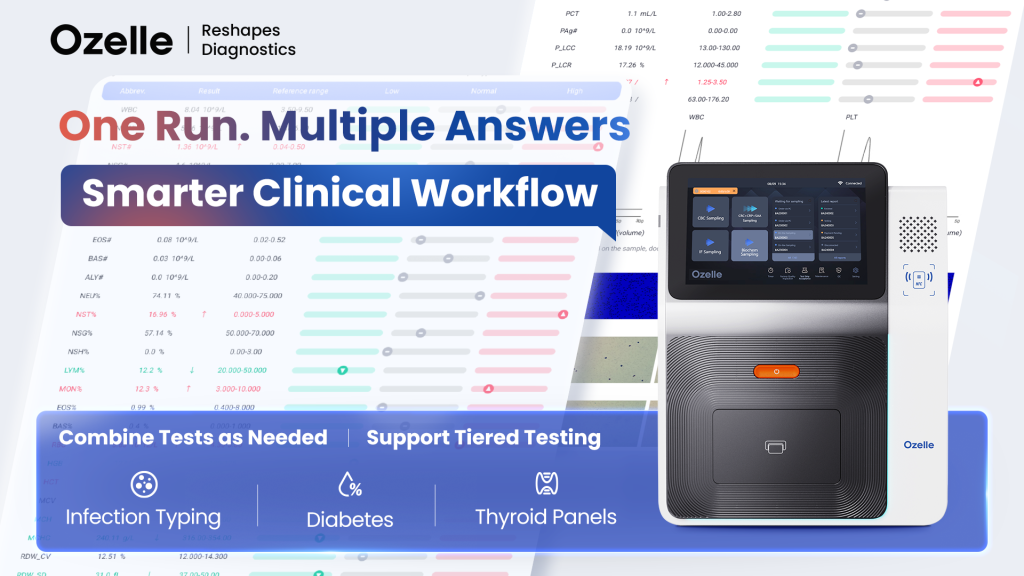

District hospitals (daily patient volume 200-500) require 7-differential hematology analyzers providing comprehensive diagnostic coverage. Primary health centers (5-10 daily samples) can deploy point-of-care testing platforms enabling same-day diagnosis. Diagnostic laboratory chains need integrated platforms (hematology, immunoassay, biochemistry testing) accommodating space constraints.

CDSCO Regulatory Navigation: 6-9 Month Approval Pathway

Registration Process and Timeline

CDSCO requires proof of home-market approval (FDA or CE certification accepted; India does not mandate separate clinical trials). Critical documentation includes detailed device specifications, manufacturing facility information, and quality management system certificates (ISO 13485:2016 mandatory).

Manufacturing facilities require GMP compliance verification; Class C and D devices mandate on-site inspection, adding 1-2 months to the cycle. Importers must appoint an authorized agent and obtain Form MD-15 registration, valid for 5 years. Total timeline: 6-9 months for standard review; 9-15 months if technical presentation or expert review is required.

Post-Registration Continuing Obligations

Serious adverse events must be reported to CDSCO. License renewal requires submission 6-9 months before the 5-year expiration. Product design modifications, labeling changes, and manufacturing location changes require prior notification. Each brand requires independent fees, though one import license can cover multiple product models.

Distributor Strategy: Local Partnership Architecture

Distributor Selection Criteria

Geographic coverage is paramount: establishing direct offices in major cities (Delhi, Mumbai, Bangalore, Chennai, Hyderabad, Kolkata) rather than relying solely on dealer networks. Service infrastructure must include technician networks for installation, staff training, and maintenance—critical for customer satisfaction in underserved markets.

Government procurement expertise is equally essential: distributors need relationships with state health departments, hospital chains, and district administrators to participate in tenders. Regional training capacity proves more effective than centralized vendor training.

Multi-Channel Distribution Strategy

Hospital network partnerships achieve system-wide standardization: premium analyzers deployed centrally, budget platforms in clinic networks. Government procurement typically occurs through centralized state health department processes; distributors must understand documentation requirements, reimbursement timelines, and price sensitivity. Pharmacy-based testing (emerging model) expands in select states, requiring compact design and minimal training requirements. Diagnostic laboratory chains (Dr. Lal PathLabs, Metropolis, Agilus, Redcliffe) consolidate volumes and expand market reach.

Infrastructure Adaptation: Power, Connectivity, and Maintenance Realities

Power Supply Challenges and Solutions

50% of primary health centers lack assured power supply; voltage fluctuations damage sensitive diagnostic equipment. Power quality issues (transients, frequency variations) increase device failure rates; solutions include uninterruptible power supplies, voltage stabilizers, and copper-based isolation transformers. Maintenance-free design is critical: analyzers requiring minimal technician intervention adapt to resource-constrained settings.

Connectivity and Offline-First Architecture

Many tier-2 and tier-3 city facilities lack reliable internet; offline-first devices with batch synchronization overcome operational constraints. Batch processing enables local result storage with upload upon connectivity restoration. Room-temperature consumable storage requires humidity-resistant cartridge design.

Pricing Strategy: Tiered Solutions for Budget-Constrained Facilities

Regional Price Differentiation

Asia-Pacific diagnostic services are priced 40-60% below North American equivalents, compressing importer margins. State-level cost variations reach 1.5-fold differences (Kerala vs. Odisha), necessitating state-specific pricing. Tier-2 and tier-3 cities demonstrate price sensitivity: per-visit costs of INR 91-657 (USD 1.09-7.88) constrain acceptable analyzer pricing.

Financing Models Unlocking Adoption

The medical equipment financing market grows at 12.38% CAGR; fixed monthly payments combined with equipment upgrade options attract budget-constrained healthcare institutions. Pay-per-use models sharing revenue with diagnostic labs/hospitals reduce upfront capital barriers. Equipment vendor financing bypasses third-party lenders. Lease-to-own structures are popular in South India’s diagnostic hub cities.

Entry-Level Pricing Tiers

Primary health center analyzers (5-differential complete blood count): USD 8,000-15,000, targeting clinic budgets. Mid-tier platforms (7-differential morphology): USD 20,000-35,000 for district hospitals. Premium integrated systems (hematology + biochemistry + immunoassay): USD 40,000-60,000 for diagnostic laboratory chains. Reagent consumable gross margins of 50-70% sustain distributor relationships.

Market Entry Risks and Mitigation

Regulatory Uncertainty and Mitigation Measures

States operate different tender timelines and documentation requirements; mitigate through regional regulatory consulting partnerships. CDSCO approval suffices for national imports, but state-level licensing variations exist; appoint authorized agents with multi-state experience.

Distributor Quality and Performance

Distributor inventory commitment is critical for tier-2 and tier-3 market penetration; underinvested distributors fail. Performance clauses (minimum quarterly sales, training delivery, service response times) protect market position.

Conclusion: Strategic Positioning 2025-2030

India’s diagnostic market inflection—driven by government infrastructure investment, tier-2 and tier-3 city expansion, and emerging middle-class healthcare spending—creates a 5-7 year window for importers to establish distribution networks before domestic manufacturers consolidate market share. Success requires four essential elements: (1) regulatory navigation efficiency (6-9 month CDSCO pathway), (2) local distributor partnerships with service infrastructure, (3) tiered pricing/financing solutions addressing budget constraints, (4) infrastructure-appropriate design accommodating power and connectivity realities. Importers executing these strategies position themselves to capitalize on India’s fastest-growing emerging-market diagnostic opportunity.

References and Source Links

https://www.linkedin.com/pulse/india-medical-equipment-financing-market-2031f-shivam-sharma-opchc

https://www.mordorintelligence.com/industry-reports/clinical-laboratory-services-market

https://pmc.ncbi.nlm.nih.gov/articles/PMC7519005

https://copperindia.org/understanding-the-impact-of-poor-power-quality-pq-in-healthcare-facilities

https://medicalbuyer.co.in/diagnostic-testing-demand-rising-in-smaller-towns-labs-plan-expansion

https://www.marketresearchfuture.com/reports/india-hematology-diagnostics-market-45392

https://www.trade.gov/market-intelligence/india-medical-devices

https://www.emergobyul.com/services/india-cdsco-medical-device-registration-and-approval

https://www.mordorintelligence.com/industry-reports/clinical-laboratory-services-market

https://medicalbuyer.co.in/diagnostic-testing-demand-rising-in-smaller-towns-labs-plan-expansion