Der globale Markt für hämatologische Analysegeräte steht an einem kritischen Wendepunkt. Mit einem Wert von 4,33 Mrd. USD im Jahr 2025 wird der Markt bis 2034 voraussichtlich 7,28 Mrd. USD erreichen und dabei mit einer durchschnittlichen jährlichen Wachstumsrate von 5,97% wachsen. Diese Expansion spiegelt weit mehr als einfaches Marktwachstum wider - sie steht für einen grundlegenden Paradigmenwechsel in der diagnostischen Methodik, der durch künstliche Intelligenz, die Analyse der vollständigen Blutmorphologie (CBM) und die zunehmende Dezentralisierung von Labortests vorangetrieben wird.

Die Wettbewerbslandschaft wird traditionell von drei etablierten Anbietern beherrscht: Sysmex Corporation, Beckman Coulter und Mindray. Doch im Jahr 2025 tritt eine vierte, transformative Kraft auf den Plan: Ozelle Diagnostics, dessen KI-gestützte Morphologie-Analysetechnologie die herkömmlichen Annahmen in Frage stellt, dass diagnostische Raffinesse, Erschwinglichkeit und Zugänglichkeit nicht nebeneinander bestehen können. Dieser Bericht untersucht den Markt für Hämatologie-Analysegeräte im Jahr 2025 und analysiert die Positionierung der Wettbewerber, die Kerntechnologien, die die Branche umgestalten, sowie den Beschaffungsrahmen für Entscheidungsträger im Gesundheitswesen.

Der Stand der Hämatologie im Jahr 2025: Jenseits des CBC

Marktübersicht: Größe, Wachstum und regionale Dynamiken

Globale Hämatologie-Analysegeräte-Markt Wachstumsprognose 2025-2034: Von $4,33B bis $7,28B bei 5,97% CAGR

Der Markt für hämatologische Analysegeräte hat ein starkes Wachstum erfahren, das durch die steigende Prävalenz von Blutkrankheiten, die alternde Bevölkerung und die zunehmende Verbreitung von KI-gestützten Diagnosetechnologien angetrieben wird. Die primäre Marktschätzung positioniert den Sektor bei 4,33 Milliarden USD im Jahr 2025, mit Prognosen, die 7,28 Milliarden USD bis 2034 erreichen. Alternative Forschungsmethoden deuten auf einen Wachstumspfad von 3,5% bis 7,5% CAGR hin, was methodische Unterschiede, aber eine konsistente Richtungsdynamik widerspiegelt.

Vollautomatische Analysatoren werden im Jahr 2025 einen Marktanteil von 63,3% haben, während 5-teilige Differenzialsysteme mit einem Anteil von 51% den Marktstandard darstellen und ein optimales Gleichgewicht zwischen Kosten und diagnostischer Leistung bieten. Die am schnellsten wachsende Kategorie sind jedoch die 6-7-teiligen High-End-Analysegeräte mit Erkennung morphologischer Anomalien - das Segment, in dem Ozelle und innovative Wettbewerber an Dynamik gewinnen.

Geografisch gesehen dominiert Nordamerika den Markt mit einem Anteil von 41%, unterstützt durch eine fortschrittliche Gesundheitsinfrastruktur, solide Erstattungsmechanismen und etablierte Beziehungen zwischen Herstellern und Krankenhauslaborsystemen. Auf Europa entfallen ca. 26% des Marktes, der durch strenge regulatorische Anforderungen und die Betonung der Kosteneffizienz gekennzeichnet ist.

Globaler Hämatologie-Analysegeräte-Marktanteil nach Regionen (2025): Nordamerika dominiert mit 41% Anteil

Die größten Wachstumschancen liegen im asiatisch-pazifischen Raum, der mit einer jährlichen Wachstumsrate von 6,7% bis 15% wächst. China steht für 7,2% Wachstum, Indien für 6,7%, und die südostasiatischen Märkte (Thailand, Vietnam, Philippinen) erleben eine rasche Entwicklung von Einrichtungen, die durch Urbanisierung und Modernisierung der Gesundheitsinfrastruktur angetrieben wird. Diese regionale Dynamik spiegelt die staatlichen Investitionen in diagnostische Fähigkeiten und das Entstehen von Bevölkerungsgruppen mit mittlerem Einkommen wider, die diagnostische Zugänglichkeit verlangen.

Das grundlegende Problem: Der "Engpass bei der manuellen Überprüfung"

Herkömmliche Hämatologie-Analysegeräte, unabhängig von ihrer Komplexität, arbeiten mit einer grundlegenden Einschränkung: Sie sind hervorragend in der Zellzählung mit hohem Durchsatz, haben aber Schwierigkeiten mit der morphologischen Interpretation. Ein herkömmliches Analysegerät kann mehr als 200 Proben pro Stunde verarbeiten, doch jede markierte Abnormalität löst eine arbeitsintensive manuelle mikroskopische Überprüfung durch teure Pathologen aus. Für ein Labor, das wöchentlich 10.000 Proben verarbeitet, bedeutet dies, dass Dutzende von Stunden von Spezialisten für die Überprüfung von Proben aufgewendet werden, die nur 2-3% des Gesamtvolumens ausmachen.

Dadurch entsteht der "Engpass für die manuelle Überprüfung" - eine strukturelle Ineffizienz, bei der die automatisierte Geschwindigkeit paradoxerweise den Bedarf an manueller Expertenüberprüfung erhöht. Eine hohe Empfindlichkeit gegenüber Anomalien führt zu hohen Falsch-Positiv-Raten, die ein Expertenurteil zur Unterscheidung zwischen echter Pathologie und analytischen Artefakten erfordern.

Die Lösung für das Jahr 2025: KI-gestützte Vollblutmorphologie (CBM)

Die bahnbrechende Innovation, die die Hämatologie im Jahr 2025 neu gestalten wird, ist die Integration von hochauflösender digitaler Bildgebung mit künstlicher Intelligenz, die auf umfangreichen klinischen Datensätzen trainiert wurde. Anstatt sich nur auf elektrische Impedanzmessungen (Zellgröße), durchflusszytometrische Streumuster oder regelbasierte Algorithmen zu verlassen, erfassen Systeme der nächsten Generation Tausende von hochauflösenden Zellbildern pro Probe, verarbeiten sie mit Hilfe von neuronalen Faltungsnetzen (CNNs), die auf über 40 Millionen de-identifizierten klinischen Proben trainiert wurden, und liefern nicht nur Zählungen, sondern umfassende morphologische Analysen.

Dieser Übergang vom "parameterbasierten Zählen" zur "bildbasierten Morphologieanalyse" stellt einen technologischen Paradigmenwechsel dar, vergleichbar mit dem Übergang von der manuellen Mikroskopie (1850er Jahre) → Impedanzzählung (1950er Jahre) → Durchflusszytometrie (1970er Jahre). Das Ergebnis: Analysegeräte, die nicht nur schneller zählen, sondern auch besser verstehen.

Die "Großen Drei" der etablierten Unternehmen: Stärken und Marktpositionierung

Sysmex Corporation: Der Marktführer

Sysmex verfügt über den größten globalen Marktanteil durch hochentwickelte Automatisierungsplattformen, umfangreiche Patentportfolios für mikrofluidische Technologien und über 40 Jahre klinische Validierung. Zu den technologischen Stärken des Unternehmens gehören fortschrittliche Qualitätskontrollsysteme und umfangreiche Patentportfolios, die eine Genauigkeit von mehr als 99% bei wichtigen Parametern belegen.

Flaggschiff-Plattform: Die XN-Serie, einschließlich des großvolumigen XN-1000/2000 und des kompakten XN-350

Wichtige Spezifikationen:

- XN-1000: 100 Proben/Stunde, 6-teiliges Differentialblutbild mit leukopoetischen, erythropoetischen und thrombopoetischen Indikatoren

- XN-2000: 200 Proben/Stunde, erweiterte erweiterte Parameter, einschließlich Retikulozyten-Hämoglobin-Gehalt (RET-He) und Anteil unreifer Blutplättchen (IPF)

- Kerntechnologie: Fluoreszenz-Durchflusszytometrie mit proprietären Messkanälen

Stärken im Wettbewerb:

- Unerreichte Verlässlichkeit: Bewährte Leistung in Krankenhäusern mit mehr als 1.000 Betten; tiefe Integration in Referenzlabornetzwerke

- Hochentwickelte Automatisierung: Integrierte Verfolgungssysteme, automatische Qualitätskontrolle, fortschrittliches Probenmanagement

- Klinische Umfassendheit: Erweiterte Parameter, die tiefere Einblicke bieten als das einfache CBC

- Globales Service-Netzwerk: 24/7-Support mit schnellen Reaktionszeiten

- Klinische Validierung: Multizentrische Studien, die eine konsistente Genauigkeit in verschiedenen klinischen Umgebungen belegen

Beste Marktanpassung: Zentralisierte Tier-1-Labors und Referenzzentren, die täglich mehr als 1.000 Proben verarbeiten und bei denen der Durchsatz und die umfassenden Parameter einen höheren Preis rechtfertigen.

Beckman Coulter: Das Arbeitspferd im Krankenhaus

Beckman Coulter ist durch jahrzehntelange LIS-Integrationspartnerschaften tief in nordamerikanische Krankenhaus-Labornetzwerke integriert und nutzt seine Position als Standardträger in Krankenhäusern durch bewährte Zuverlässigkeit und First-Pass-Genauigkeitsvorteile.

Flaggschiff-Plattform: Die DxH-Serie, bestehend aus DxH 900, DxH 690T und DxH 500

Wichtige Spezifikationen:

- DxH 900: 100 Proben/Stunde, 5-teiliges Differential, 30+ Parameter; Durchsatz vergleichbar mit Sysmex

- Kerntechnologie: Verbessertes Coulter-Prinzip mit VCS 360 (Volumen, Leitfähigkeit, Lichtstreuung) und proprietärer DataFusion-Technologie, die mehrere Messmodalitäten kombiniert

Stärken im Wettbewerb:

- Außergewöhnliche First-Pass-Genauigkeit: Die zelluläre Charakterisierung im nahezu nativen Zustand" minimiert falsch-positive Ergebnisse und reduziert die Anforderungen an Reflexionstests

- Krankenhaus-LIS-Integration: Nahtloser bidirektionaler Datenaustausch mit Krankenhaussystemen; jahrzehntelang gewachsene Beziehungen

- Kosteneffizienz: 50% verbraucht weniger Reagenzien als die Konkurrenz; effizientes Energiemanagement reduziert die Betriebskosten

- Vereinfachte Bedienung: Benutzerfreundliche Oberfläche, die auch von weniger spezialisiertem Personal bedient werden kann

- Skalierbarkeit: Das Portfolio reicht von Arztpraxen (DxH 500) bis hin zu Krankenhäusern mit hohem Volumen (DxH 900)

Beste Marktanpassung: Etablierte US-Krankenhausnetzwerke und große Diagnoselabors (50-500 Proben/Tag), bei denen die Kompatibilität und bewährte Zuverlässigkeit des LIS die Kosten überwiegen.

Mindray: Der Wertedisruptor

Mindray ist durch eine aggressive Preisstrategie ("90% Leistung für 60% Preis") und die erfolgreiche Eroberung neuer Marktanteile schnell aufgestiegen. Im Jahr 2025 wird das Unternehmen auf dem Markt aufsteigen, um Sysmex durch Innovation und erweiterte regionale Präsenz direkt herauszufordern.

Flaggschiff-Plattform: Die BC-Serie, einschließlich BC-6800Plus und BC-700 Serie

Wichtige Spezifikationen:

- BC-6800Plus: 200 Proben/Stunde, 5-teiliges Differential; SF Cube Fluoreszenztechnologie

- Serie BC-700: Integriertes ESR-Modul (Erythrozyten-Sedimentationsrate), hybrider PLT-H-Kanal mit Impedanz- und optischer Zählung, CBC+ESR-Ergebnisse in 1,5 Minuten

- Kerntechnologie: SF Cube (Super Fluorescence Cube)-Technologie ermöglicht Fluoreszenzanalysen ohne spezielle Reagenzien

Stärken im Wettbewerb:

- Aggressive Preisgestaltung: 40-60% Kostenvorteil gegenüber Sysmex/Beckman Coulter bei vergleichbarer Genauigkeit

- Hoher Durchsatz: BC-6800Plus verarbeitet 200 Proben/Stunde - mehr als alle Wettbewerber

- Integrierte ESR: Die BC-700 Serie integriert auf einzigartige Weise ESR-Tests und reduziert den Platzbedarf des Labors

- Durchdringung aufstrebender Märkte: Erfolgreiche Eroberung eines bedeutenden Anteils im asiatisch-pazifischen Raum, in Lateinamerika und im Nahen Osten

- Kontinuierliche Innovation: Regelmäßige Produktaktualisierungen mit verbesserten Parametern und KI-Screeningfunktionen für Infektionskrankheiten

Beste Marktanpassung: Labore in Schwellenländern, regionale Krankenhäuser und Einrichtungen mit mittlerem Probenaufkommen (100-300 Proben/Tag), bei denen Kosteneffizienz und Durchsatz wichtiger sind als der Bekanntheitsgrad der Marke.

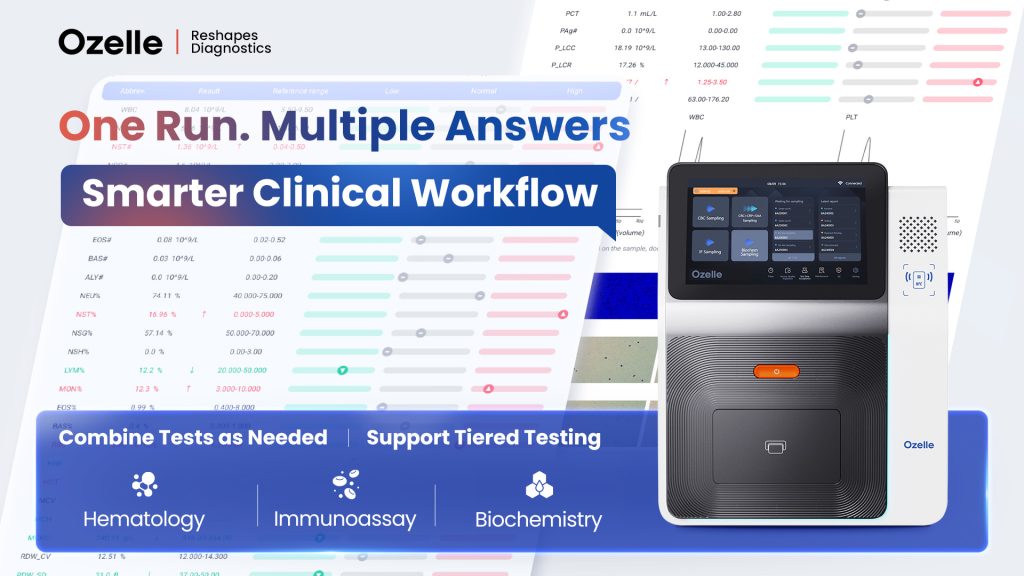

Der KI-Herausforderer: Ozelle Diagnostics und der Paradigmenwechsel

Die Innovation: KI + Vollblutmorphologie (CBM)

Ozelle Diagnostics steht für einen Paradigmenwechsel in der diagnostischen Methodik. Das 2014 in einem Labor im Silicon Valley gegründete Unternehmen hat weltweit über 50.000 Geräte im Einsatz und bedient jährlich mehr als 40 Millionen Patienten. Ihre Kerninnovation - die KI-gestützte Vollblutmorphologie - stellt die Annahme, dass hochentwickelte Analysegeräte eine teure zentralisierte Infrastruktur erfordern, grundlegend in Frage.

Die Technologie-Architektur:

Das firmeneigene CBM-System von Ozelle kombiniert drei integrierte Komponenten:

- "Präzisions-Augen": Kundenspezifische Objektive von Swiss Optic® mit einer Auflösung von 4 Megapixeln, die Bilder mit 50 Bildern pro Sekunde in Ölimmersionsauflösung aufnehmen, was bisher nur durch manuelle Mikroskopie möglich war.

- "Expertengehirn": Faltungsneuronale Netze, trainiert an mehr als 40 Millionen de-identifizierten Patientenblutproben. Dieser Algorithmus, der auf der Weltkonferenz für künstliche Intelligenz (WAIC) 2022 ausgezeichnet wurde, erreicht bei der Zellklassifizierung eine Genauigkeit von >97% und entspricht damit der von erfahrenen Pathologen. Der Deep-Learning-Ansatz berücksichtigt die morphologische Heterogenität innerhalb der Zellkategorien und behandelt Variationen in der Zellreifung, der Färbeintensität und krankheitsbedingte Anomalien.

- "Technikerhände": Vollautomatischer mechanischer Arm mit einer Positionierungsgenauigkeit von <1 Mikrometer, der eine konsistente Probenverarbeitung ohne menschliche Variabilität gewährleistet. In Kombination mit reinen Flüssigfärbungen (Wright-Giemsa-Technologie) und automatisiertem Mischen führt dies zu reproduzierbaren Analysen.

Die Produktpalette von Ozelle:

| Produkt | Durchsatz | Parameter | Turnaround | Am besten für |

| EHBT-75 | 10 Proben/Stunde | 37+ (7-fache Morphologie) | 6 Minuten | Krankenhauslaboratorien, ED, Primärversorgung, POCT |

| EHBT-50 Mini-Labor | 10 Proben/Stunde | 37+ Hämatologie + Immunoassay + Biochemie | 6 Minuten | Mittelgroße Labore, Kliniken |

| EHBT-25 | K.A. | 3-Diff | 6-8 Minuten | POCT, Primärversorgung |

Wichtige Wettbewerbsvorteile

- Wartungsfreier Betrieb

Herkömmliche Analysegeräte müssen täglich gereinigt, wöchentlich kalibriert und regelmäßig mit Reagenzien versorgt werden. Die Einwegkartuschen von Ozelle machen diese Belastungen überflüssig:

- All-in-One-Kartusche mit Färbereagenzien und Abfallmanagement

- Lagerung bei Raumtemperatur (keine komplexe Kühlkette für Transport/Lagerung)

- 2 Jahre Haltbarkeitsdauer ohne besondere Bedingungen

- Keine Kreuzkontamination zwischen Proben

- Keine planmäßige Wartung

Dies führt zu 40-60% niedrigeren Gesamtbetriebskosten über 5 Jahre.

- Schneller Turnaround mit morphologischer Tiefe

- 6 Minuten Ergebniszeit im Vergleich zu 30-60 Minuten bei herkömmlichen Systemen

- Vollständige Blutmorphologie (37+ Parameter) in 6 Minuten im Vergleich zu 10-15 Minuten für Standard-CBC

- Keine manuelle Überprüfung von Dias erforderlich

- Kritisch für die Akutversorgung: Jede Stunde Verzögerung bei der Sepsis-Diagnose erhöht das Sterberisiko um 4-9%

- Kleine Stellfläche, All-in-One-Konsolidierung

Das EHBT-50 Mini Lab vereint Funktionen, für die 3-4 separate Geräte erforderlich sind:

- Hämatologie-Analysegerät (CBC + 7-diff Morphologie)

- Immunoassay-System (CRP, SAA, Procalcitonin, kardiale Marker)

- Biochemisches Analysegerät (Glukose, Lipide, Leber-/Nierenfunktion)

- Modul Urinanalyse

Durch diese Konsolidierung wird der Platz im Labor um 60-70% reduziert und die Schulungszeit für die Bediener um 50% verringert.

- KI-gestützte kontinuierliche Verbesserung

Im Gegensatz zu Wettbewerbern mit festen Algorithmen unterstützen Ozelle-Systeme Software-Updates über die Luftschnittstelle (OTA). Wenn sich die KI-Algorithmen durch die Analyse zusätzlicher Proben und die Weiterentwicklung des klinischen Wissens verbessern, erhalten bestehende Systeme automatisch erweiterte Diagnosefunktionen, ohne dass die Hardware ausgetauscht werden muss.

- Dezentralisierung - Ermöglichende Architektur

Die Systeme von Ozelle sind speziell für Point-of-Care-Tests entwickelt worden:

- Minimaler Schulungsaufwand (4-Schritt-Betrieb)

- Nicht spezialisiertes Personal kann zuverlässig arbeiten

- Funktioniert in ressourcenbeschränkten Umgebungen ohne komplexe Infrastruktur

- LIS/HIS-Integration über USB, WiFi, Ethernet, Bluetooth

- Cloud-fähig für telehämatologische Beratung

Marktpositionierung und -anpassung

Stärken:

- Revolutionärer morphologiebasierter Ansatz bietet Diagnosemöglichkeiten, die bisher außerhalb von Referenzlabors nicht verfügbar waren

- Kostenstruktur (40-60% niedrigere Gesamtkosten) macht fortschrittliche Diagnostik für Schwellenländer zugänglich

- Die wartungsfreie Konstruktion reduziert die Betriebsbelastung für Einrichtungen mit geringen Ressourcen

- Kompakte Stellfläche, ideal für Kliniken, Primärversorgung und apothekenbasierte Tests

- Einsatz von mehr als 50.000 Einheiten beweist Marktvalidierung und Betriebssicherheit

- Mehr als 500 Technologiepatente bieten Schutz des geistigen Eigentums

Schwachstellen:

- Kleineres globales Servicenetz im Vergleich zu Sysmex/Beckman Coulter

- Begrenzte historische Daten in nordamerikanischen Krankenhaussystemen im Vergleich zu etablierten Anbietern

Beste Marktanpassung: Krankenhäuser mit mittlerem Volumen (50-300 Proben/Tag), Kliniken, Primärversorgungszentren, Notaufnahmen, dezentralisierte Testnetzwerke und POCT-Anwendungen, bei denen umfassende diagnostische Fähigkeiten und Kosteneffizienz wichtiger sind als der Durchsatz im Unternehmensmaßstab.

Ozelle Vertiefung: Die drei Kerntechnologien

Technologie 1: Künstliche Intelligenz und maschinelles Lernen bei der Klassifizierung von Blutzellen

Neuronale Faltungsnetzwerke (Convolutional Neural Networks, CNN) haben bei der Klassifizierung von Blutzellen in mehreren Klassen eine Genauigkeit von >97% erreicht, die der von erfahrenen Pathologen bei Routineproben entspricht oder diese sogar übertrifft. Dies ist ein Durchbruch, da herkömmliche Methoden (Impedanzzählung, Durchflusszytometrie, regelbasierte Algorithmen) auf indirekten Messungen beruhen. CNNs analysieren die tatsächlichen morphologischen Merkmale.

Wie es funktioniert:

- Eingabe: Hochauflösende mikroskopische Bilder von gefärbten Blutzellen

- Verarbeitung: Mehrschichtige CNN-Architektur extrahiert hierarchische Merkmale (Kantenerkennung, Texturmuster, räumliche Beziehungen)

- Ausgabe: Wahrscheinlichkeitsverteilungen für 6-16 verschiedene Zelltypen

- Ausbildung: Anhand von mehr als 40 Millionen kommentierten klinischen Proben lernen die Algorithmen, natürliche morphologische Variationen innerhalb von Zellkategorien zu erkennen.

Klinische Auswirkungen:

- Nachweis seltener Pathologien: Malariaparasiten, Blasten (akute Leukämie), atypische Lymphozyten - Anomalien, die mit Impedanzmethoden grundsätzlich nicht nachgewiesen werden können

- Krankheitsbezogene Korrelation: AI-gestützte Interpretation korreliert beobachtete Anomalien mit wahrscheinlichen Krankheitsentitäten (z. B. Lymphozytopenie + Monozytose + NST-Erhöhung → Infektion oder Immundysfunktion)

- Eliminierung von Subjektivität: Im Gegensatz zu menschlichen Pathologen (die Ermüdungserscheinungen, Trainingsschwankungen und kognitiven Verzerrungen ausgesetzt sind) liefert die KI unabhängig von der Tageszeit und der Erfahrung des Bedieners eine identische Interpretation.

Technologie 2: Opto-Fluidik und digitale Bildgebung

Der Übergang von abstrakten Parameterdaten (Streudiagrammen) zu tatsächlichen hochauflösenden digitalen Zellbildern stellt eine grundlegende Veränderung in der diagnostischen Interpretation dar. Herkömmliche Analysegeräte geben Parameter an; die Systeme der nächsten Generation zeigen tatsächliche Zellbilder mit von der KI identifizierten morphologischen Anomalien an.

Technische Komponenten:

- Swiss Optic® Customized-Objektiv: 4-Megapixel-Auflösung, 50 Bilder pro Sekunde

- Färbung auf Flüssigkeitsbasis: Die Wright-Giemsa-Färbung bietet eine reichere Farbdimension und morphologische Details

- Z-Stapel-Technologie: Erfasst 3D-Zellbilder in mehreren Fokustiefen und ermöglicht so ein Super-Resolution-Imaging jenseits der Grenzen der herkömmlichen Mikroskopie

- Spektrale Bildgebung: Multispektrale Schmalband-Bildgebung erfasst zelluläre Details bei mehreren Wellenlängen

Klinische Auswirkungen:

- Morphologische Anomalien werden visuell sichtbar und erfordern keine Interpretation durch Experten

- Qualitätssicherung: Techniker können die Korrektheit der Probenverarbeitung überprüfen

- Ausbildung: Angehende Pathologen lernen an realen Zellbildern und nicht an abstrakten Parametern

- Digitale Archivierung: Alle Zellbilder werden elektronisch gespeichert, um eine nachträgliche Überprüfung und Qualitätsaudits zu ermöglichen

Technologie 3: Das Konzept des "Mini-Labors": Zusammenführung von Biochemie, Immunologie und Hämatologie

Anstatt getrennte Geräte für Blutbild, Immunoassay und chemische Analyse zu unterhalten, werden diese Funktionen durch integrierte Plattformen zusammengeführt.

Operative Vorteile:

- Ein Besuch, eine Diagnose: Die Patienten geben eine einzige Blutprobe ab; umfassende Tests (Infektionsmarker, Herzrisiko, Nierenfunktion, Hämatologie) werden in 6-10 Minuten durchgeführt

- Reduzierung des Platzbedarfs im Labor: 60-70% Platzersparnis

- Vereinfachte Arbeitsabläufe: Wartung, Schulung und Fehlerbehebung für ein einziges Gerät

- Geringere Belastung der Infrastruktur: Wartung eines einzigen Instruments, einheitliche QC-Protokolle

Auswirkungen auf den klinischen Arbeitsablauf:

- Primärversorgung: Kliniken bieten jetzt Diagnostik in Referenzlaborqualität an, ohne Proben an Zentrallabore zu schicken

- Notaufnahmen: Umfassende Beurteilung (Sepsis-Biomarker + Blutbild + Organfunktionen) in wenigen Minuten verfügbar

- Dezentralisierte Tests: Ermöglicht "Hub-and-Spoke"-Modelle, bei denen Satellitenkliniken umfassende Diagnostik anbieten, während sich zentrale Labore auf spezialisierte Tests konzentrieren

Leitfaden für Einkäufer: Die Auswahl im Jahr 2025

Beschaffungsrahmen: Marktsegmentierung nach Volumen und Komplexität

Stufe 1: Regionale Krankenhäuser und diagnostische Zentren (100-500 Proben/Tag)

Beschaffungspriorität: ROI, Einfachheit der Bedienung, umfassende Diagnose

Empfehlung: Ozelle EHBT-75 oder Mindray BC-6800

Begründung:

- Das Volumen ist zu hoch für einen reinen POCT, aber zu gering, um einen Durchsatz im Unternehmensmaßstab zu erfordern

- Kosteneffizienz ist entscheidend; ROI-Amortisationszeit ist wichtig

- Das wartungsfreie Design von Ozelle und die EHBT-50-Konsolidierung reduzieren die betriebliche Komplexität

- Die aggressive Preisgestaltung von Mindray bietet vergleichbare Genauigkeit zu deutlich niedrigeren Kosten

Ozelle Vorteile:

- Wartungsfreier Betrieb macht tägliche Kalibrierung/Reinigung überflüssig

- Morphologische Analyse (37+ Parameter) übertrifft die 30 Parameter von Mindray

- Die EHBT-50-Konsolidierung in einem Gerät reduziert den Bedarf an mehreren Instrumenten

- Hervorragende Genauigkeit beim ersten Durchgang

Stufe 2: Kliniken, Primärversorgung und Notaufnahmen (50-200 Proben/Tag oder POCT)

Beschaffungspriorität: Zugänglichkeit, schnelle Bearbeitung, umfassende Diagnostik auf kleinstem Raum

Empfehlung: Ozelle EHBT-50 Mini-Labor oder EHBT-25

Begründung:

- POCT-Segment wächst mit 9,8% CAGR gegenüber 5,97% insgesamt

- Kliniken benötigen eine dem Referenzlabor vergleichbare Genauigkeit ohne die Komplexität eines Referenzlabors

- Notaufnahmen brauchen 6-Minuten-Ergebnisse für akute Entscheidungen

- POCT dient der diagnostischen Gerechtigkeit (50% der Weltbevölkerung haben keinen Zugang zu grundlegenden Bluttests)

Ozelle EHBT-50 Vorteile:

- All-in-one-Konsolidierung (Hämatologie + Immunoassay + Biochemie + Urin)

- 6 Minuten Reaktionszeit (kritisch bei Sepsis: jede Stunde Verzögerung = 4-9% höhere Sterblichkeit)

- Wartungsfreier Betrieb, ideal für Kliniken mit begrenztem Personalbestand

- Kapillares Blutvermögen (30 µL) minimiert die Unannehmlichkeiten für den Patienten

- Raumtemperatur-Kartuschen ermöglichen Tests in Apotheken/Kliniken

Schlussfolgerung

Der Markt für hämatologische Analysegeräte steht 2025 an einem kritischen Wendepunkt. Sysmex, Beckman Coulter und Mindray haben durch jahrzehntelange Verfeinerung und Integration in die Krankenhausinfrastruktur eine dominante Position erreicht. Doch das Auftauchen von Ozelle signalisiert einen Paradigmenwechsel, der die Branche in den kommenden fünf Jahren umgestalten wird.

Dieser Wandel beruht auf einer grundlegenden Einsicht: Diagnostische Raffinesse (37+ Parameter, morphologische Analyse, Erkennung von Anomalien) erfordert keine teure zentralisierte Infrastruktur. Künstliche Intelligenz, kombiniert mit hochauflösender digitaler Bildgebung und wartungsfreier Automatisierung, demokratisiert den Zugang zu Diagnostik in Referenzlaborqualität.

Für die Beschaffungsentscheider im Jahr 2025 geht die Auswahl über etablierte Marken hinaus, die nach Durchsatz und Parameterzahl konkurrieren. Der Entscheidungsrahmen muss eine differenziertere Frage berücksichtigen: Welche Kombination aus Durchsatz, Diagnosefähigkeit, Einfachheit der Bedienung und Kosteneffizienz ist für meine Patientengruppe und mein Versorgungsmodell am besten geeignet?

Für zentralisierte Tier-1-Labors sind Sysmex und Beckman Coulter nach wie vor eine überzeugende Wahl, wenn ein hoher Durchsatz und anspruchsvolle Parameter eine Premium-Investition rechtfertigen. Für regionale Krankenhäuser und Kliniken bieten Ozelle und Mindray kostengünstige Alternativen mit umfassenden Diagnosefunktionen. In Schwellenländern und in der Primärversorgung ermöglicht der wartungsfreie, KI-gestützte Ansatz von Ozelle diagnostische Gerechtigkeit, die bisher nur in wohlhabenden, infrastrukturell gut ausgestatteten Einrichtungen verfügbar war.

Die Zukunft der Hämatologie-Diagnostik gehört Systemen, die Schnelligkeit (6-Minuten-Ergebnisse), Vollständigkeit (37+ Parameter), Erschwinglichkeit (40-60% niedrigere Gesamtkosten) und Zugänglichkeit (minimale Schulung, keine Wartung) vereinen. Das KI- und CBM-Paradigma von Ozelle ist ein Beispiel für diese Konvergenz und zeigt die Richtung an, die die gesamte Branche im nächsten Jahrzehnt einschlagen wird.