Introduction

The global hematology analyzer market has experienced remarkable transformation over the past decade. Valued at approximately USD 4.33 billion in 2025, the market is projected to reach USD 7.28 billion by 2034, expanding at a compound annual growth rate of 5.97%. This expansion reflects a fundamental shift in diagnostic delivery—from centralized, specialist-dependent laboratory processes to distributed, accessible solutions deployable across diverse healthcare settings.

For healthcare administrators, laboratory directors, and procurement specialists, selecting the best hematology analyzer distributor represents one of the most critical decisions affecting diagnostic quality, operational efficiency, and total cost of ownership. A distributor partnership extends far beyond simple equipment procurement; it fundamentally defines your facility’s diagnostic capabilities for the next decade and positions your organization to deliver timely, accurate diagnostics as healthcare systems worldwide prioritize both efficiency and accessibility.

Understanding the Hematology Analyzer Market Landscape

Market Structure and Key Players

The hematology analyzer market exhibits moderate competitiveness with established global leaders and emerging innovators competing for market share. As of 2024, the key players operating in this market include Sysmex Corporation (Japan), Danaher Corporation (USA), Beckman Coulter (USA), Siemens Healthineers (Germany), Abbott Laboratories (USA), and Horiba Medical (France). Each manufacturer brings distinct technological approaches, pricing strategies, and market positioning that affect distributor relationships and end-user value.

Traditional Market Leaders:

Sysmex Corporation stands as one of the world’s preeminent hematology analyzer manufacturers, commanding substantial global market share through its comprehensive product portfolio and advanced technological capabilities. The company operates extensively across North America, Europe, Asia-Pacific, the Middle East, and Africa, leveraging deep-rooted relationships with hospital laboratory systems and reference centers.

Beckman Coulter, part of the Danaher Corporation, maintains substantial market presence with its DxH series of hematology analyzers and integrated diagnostic systems. The company is known for impedance-based technology, high throughput capacity, and extensive clinical validation across multiple healthcare settings.

Siemens Healthineers operates as a global medical technology leader offering integrated laboratory solutions combining hematology analyzers with comprehensive automation, workflow optimization, and advanced data management capabilities. The company emphasizes laboratory system integration, recognizing that isolated analytical devices provide limited value without seamless integration into institutional workflows.

Emerging Innovation in Hematology Diagnostics

The market is witnessing a paradigm shift driven by artificial intelligence (AI) integration and advanced optical imaging technologies. Ozelle Diagnostics exemplifies this emerging category of manufacturers combining Silicon Valley innovation with precision engineering to deliver next-generation diagnostic capabilities. Founded in 2014 from a laboratory in Silicon Valley and headquartered in Frankfurt, Germany, Ozelle has established itself as a leader in AI-powered hematology analysis through innovative applications of machine learning and advanced optical imaging.

Ozelle’s rapid market penetration reflects genuine clinical value and operational advantages. The company has deployed over 50,000 units globally across 40+ countries, analyzing 40+ million patient samples annually. This substantial deployment base provides machine learning training data enabling continuous algorithm improvement, creating virtuous cycles where diagnostic accuracy improves with each additional sample processed.

Critical Selection Criteria for the Best Hematology Analyzer Distributor

Technical Excellence and Diagnostic Accuracy

The foundation of any distributor partnership must rest upon technological excellence and demonstrated diagnostic accuracy. When evaluating potential distributors, prioritize manufacturers with:

Clinical Validation and Performance Metrics: Ensure the analyzer provides consistent, high-precision results verified through independent clinical studies. Look for low Coefficient of Variation (CV%) values demonstrating repeatability and accuracy. The EHBT-50, for example, delivers WBC correlation coefficient R² = 0.9962 with hemoglobin precision of CV ≤ 2.5%, representing accuracy indistinguishable from gold-standard laboratory instruments.

Advanced Cell Morphology Analysis: Modern hematology analyzers should employ proprietary imaging technologies enabling identification of abnormal cell morphologies beyond traditional 3-part or 5-part differentials. Complete Blood Morphology (CBM) technology, which combines AI with advanced optical imaging, enables identification of immature granulocytes (NST, NSG, NSH), reticulocytes (RET), and other morphological abnormalities critical for clinical decision-making.

Regulatory Certifications and Quality Assurance: Verify that the distributor’s products carry appropriate regulatory approvals including CE Certification (European conformance), FDA Registration (U.S. approval), ISO 13485:2016 (medical device quality management systems), and ISO 9001 (general quality management). These certifications ensure compliance with international standards and provide assurance regarding product reliability and manufacturing consistency.

Multi-Functional Integration and Operational Consolidation

Modern healthcare facilities increasingly require comprehensive diagnostic solutions beyond simple complete blood count (CBC) analysis. The best hematology analyzer distributors offer integrated platforms that consolidate multiple testing modalities:

All-in-One Testing Capabilities: Look for analyzers combining hematology, immunoassay, biochemistry, and urine/fecal analysis in a single device. The EHBT-50 Minilab exemplifies this approach, integrating:

- 7-Diff hematology with 37+ parameters

- Immunofluorescence assay for cardiac markers, inflammatory proteins, and infectious disease serology

- Dry chemistry biochemistry for glucose, lipid profiles, and renal/liver function

- Comprehensive urine and fecal analysis

This integration enables single-instrument replacement of 3-5 separate specialized analyzers, reducing laboratory footprint by 40-60%, simplifying maintenance, and improving operational efficiency.

Flexible Testing Combinations: The ability to combine tests as needed—such as CBC+CRP+SAA for infection assessment, CBC+HbA1c+glucose/lipid panel for diabetes management, or CBC+TSH+FT3+FT4 for thyroid function evaluation—allows facilities to tailor testing protocols to specific patient populations and clinical workflows.

Maintenance-Free Operations and Low Total Cost of Ownership

One of the most significant operational advantages distinguishing modern analyzers from traditional systems is maintenance-free design. Evaluate distributors offering:

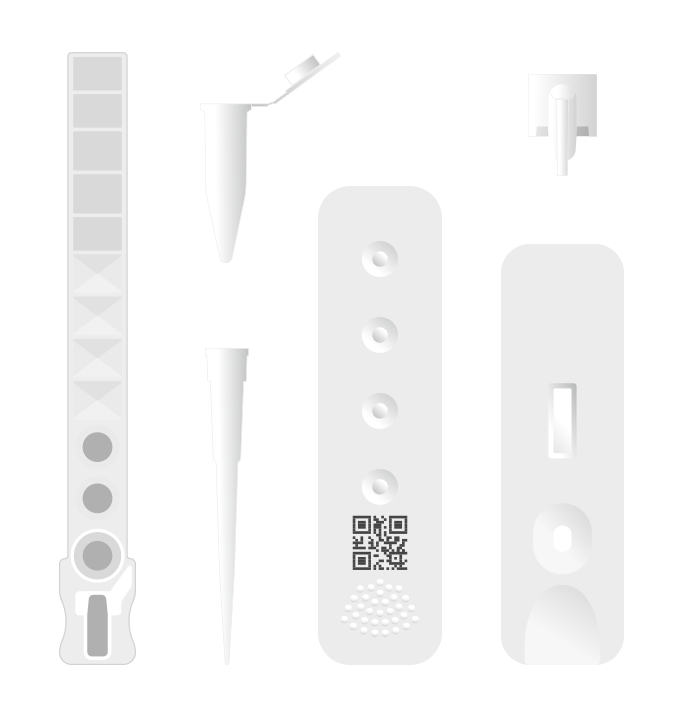

Single-Use Cartridge Technology: Individual test kits eliminate pipeline designs, frequent maintenance procedures, and reagent preparation requirements. Each cartridge ensures consistent performance with quality control built into manufacturing rather than requiring lab validation for each reagent batch.

Room Temperature Storage: Modern cartridges maintain stability at room temperature, eliminating cold-chain requirements that increase supply chain complexity and costs. This proves particularly valuable in resource-limited settings and geographic regions with inconsistent refrigeration infrastructure.

Reduced Training Requirements: Maintenance-free analyzers require only 4-step operation by non-specialist staff. Training programs typically require less than 4 hours, dramatically reducing labor costs and enabling rapid staff onboarding without specialized technician certification.

Cost Structure Analysis: Compare total cost of ownership including equipment cost, consumable expenses, maintenance overhead, training requirements, and warranty coverage. While initial equipment cost matters, long-term consumable costs and maintenance requirements often dominate total ownership calculations.

Throughput and Sample Volume Capacity

Select analyzers and distributors aligned with your facility’s diagnostic volume requirements:

Low-Volume Settings (30-60 samples/hour): Primary care clinics, occupational health centers, and urgent care facilities benefit from compact, point-of-care analyzers like the EHBT-25 or EHBT-50. These devices deliver rapid turnaround (6 minutes per sample) while requiring minimal infrastructure.

Mid-Volume Settings (100-300 samples/hour): Regional hospitals and diagnostic centers require analyzers balancing throughput capability with operational simplicity. The EHBT-75 supports 10 samples/hour suitable for district hospital networks and specialized diagnostic centers.

High-Volume Settings (100+ samples/hour): Tertiary care hospitals and reference laboratories operating 24/7 require high-throughput automation, automated sample handling, barcode scanning, and AI-powered diagnostics. These facilities benefit from systems offering comprehensive workflow automation and integration with hospital information systems (HIS) and laboratory information systems (LIS).

HIS/LIS Integration and Data Management

Modern healthcare facilities increasingly require seamless data integration between diagnostic equipment and institutional information systems. Evaluate distributors offering:

Standard Protocol Support: Look for analyzers supporting standard data communication protocols including ASTM, HL7, and alternative technologies such as WiFi, Ethernet, USB, and Bluetooth connectivity. Seamless integration enables automatic result transmission without manual data entry, reducing transcription errors and accelerating result availability to clinicians.

Cloud-Ready Architecture: Advanced analyzers should support cloud-based data management and remote consultation capabilities, enabling access to diagnostic results from any facility location and supporting telehematology consultation for complex cases.

Quality Audit Trails: Comprehensive data management platforms should provide automatic inventory monitoring, batch tracking, expiration management, serial number tracking for regulatory compliance, and detailed quality audit trails supporting regulatory investigations and continuous improvement initiatives.

Evaluating Global Hematology Analyzer Distributor Capabilities

Market Distribution by Geography

Understanding regional market dynamics helps identify distributors with relevant expertise for your geographic context:

North America (41% market share): North America maintains dominant market position driven by advanced healthcare infrastructure with universal hematology analyzer deployment, robust reimbursement mechanisms supporting premium analyzer procurement, significant healthcare spending enabling adoption of cutting-edge diagnostic technology, and established relationships between manufacturers and hospital laboratory systems.

Europe (26% market share): European markets are characterized by stringent regulatory requirements, emphasis on cost-efficiency, established hospital and diagnostic lab networks, and growing adoption of integrated automation solutions in response to technologist shortages.

Asia-Pacific (18% market share): Asia-Pacific represents the fastest-growing region, projected for 8.2% CAGR through 2034. Growth reflects structural recognition that AI-powered diagnostic systems can bypass traditional infrastructure limitations, democratizing access to expert-level diagnostics across geographies and income levels. Government health system expansion through UHC initiatives creates enormous procurement opportunities.

Emerging Markets (15% market share): Latin America, Africa, and South Asia present distinct distribution opportunities through government procurement channels, pharmacy-based testing partnerships, and hospital network collaborations. Success requires understanding regional healthcare delivery models and culturally-adapted distribution strategies.

Distributor Network Architecture and Service Capabilities

The best hematology analyzer distributors maintain comprehensive service infrastructure extending beyond simple equipment supply:

Regional Training Centers: Position training facilities to support local distributor networks rather than relying solely on centralized training. Training programs should encompass operational procedures, quality control protocols, maintenance procedures, and troubleshooting methodologies.

Technical Support Infrastructure: Maintain technician networks supporting installations, on-site troubleshooting, preventive maintenance protocols, and emergency service response. Service capability often determines whether distributors can compete in competitive healthcare markets where equipment downtime directly impacts facility revenue.

Spare Parts Logistics: Establish local supply chains for consumables and replacement components. Distributors maintaining local inventory can respond to facility needs within 24-48 hours, minimizing operational disruption.

Regulatory Expertise: Skilled distributors navigate complex regulatory environments including device registration, quality system documentation, adverse event reporting, and post-market surveillance requirements. This expertise proves particularly valuable in emerging markets with evolving regulatory frameworks.

Ozelle: A Case Study in Advanced Hematology Analyzer Distribution

Technical Excellence and Diagnostic Accuracy

The foundation of any distributor partnership must rest upon technological excellence and demonstrated diagnostic accuracy. When evaluating potential distributors, prioritize manufacturers with:

Clinical Validation and Performance Metrics: Ensure the analyzer provides consistent, high-precision results verified through independent clinical studies. Look for low Coefficient of Variation (CV%) values demonstrating repeatability and accuracy. The EHBT-50, for example, delivers WBC correlation coefficient R² = 0.9962 with hemoglobin precision of CV ≤ 2.5%, representing accuracy indistinguishable from gold-standard laboratory instruments.

Advanced Cell Morphology Analysis: Modern hematology analyzers should employ proprietary imaging technologies enabling identification of abnormal cell morphologies beyond traditional 3-part or 5-part differentials. Complete Blood Morphology (CBM) technology, which combines AI with advanced optical imaging, enables identification of immature granulocytes (NST, NSG, NSH), reticulocytes (RET), and other morphological abnormalities critical for clinical decision-making.

Regulatory Certifications and Quality Assurance: Verify that the distributor’s products carry appropriate regulatory approvals including CE Certification (European conformance), FDA Registration (U.S. approval), ISO 13485:2016 (medical device quality management systems), and ISO 9001 (general quality management). These certifications ensure compliance with international standards and provide assurance regarding product reliability and manufacturing consistency.

Multi-Functional Integration and Operational Consolidation

Modern healthcare facilities increasingly require comprehensive diagnostic solutions beyond simple complete blood count (CBC) analysis. The best hematology analyzer distributors offer integrated platforms that consolidate multiple testing modalities:

All-in-One Testing Capabilities: Look for analyzers combining hematology, immunoassay, biochemistry, and urine/fecal analysis in a single device. The EHBT-50 Minilab exemplifies this approach, integrating:

- 7-Diff hematology with 37+ parameters

- Immunofluorescence assay for cardiac markers, inflammatory proteins, and infectious disease serology

- Dry chemistry biochemistry for glucose, lipid profiles, and renal/liver function

- Comprehensive urine and fecal analysis

This integration enables single-instrument replacement of 3-5 separate specialized analyzers, reducing laboratory footprint by 40-60%, simplifying maintenance, and improving operational efficiency.

Flexible Testing Combinations: The ability to combine tests as needed—such as CBC+CRP+SAA for infection assessment, CBC+HbA1c+glucose/lipid panel for diabetes management, or CBC+TSH+FT3+FT4 for thyroid function evaluation—allows facilities to tailor testing protocols to specific patient populations and clinical workflows.

Maintenance-Free Operations and Low Total Cost of Ownership

One of the most significant operational advantages distinguishing modern analyzers from traditional systems is maintenance-free design. Evaluate distributors offering:

Single-Use Cartridge Technology: Individual test kits eliminate pipeline designs, frequent maintenance procedures, and reagent preparation requirements. Each cartridge ensures consistent performance with quality control built into manufacturing rather than requiring lab validation for each reagent batch.

Room Temperature Storage: Modern cartridges maintain stability at room temperature, eliminating cold-chain requirements that increase supply chain complexity and costs. This proves particularly valuable in resource-limited settings and geographic regions with inconsistent refrigeration infrastructure.

Reduced Training Requirements: Maintenance-free analyzers require only 4-step operation by non-specialist staff. Training programs typically require less than 4 hours, dramatically reducing labor costs and enabling rapid staff onboarding without specialized technician certification.

Cost Structure Analysis: Compare total cost of ownership including equipment cost, consumable expenses, maintenance overhead, training requirements, and warranty coverage. While initial equipment cost matters, long-term consumable costs and maintenance requirements often dominate total ownership calculations.

Throughput and Sample Volume Capacity

Select analyzers and distributors aligned with your facility’s diagnostic volume requirements:

Low-Volume Settings (30-60 samples/hour): Primary care clinics, occupational health centers, and urgent care facilities benefit from compact, point-of-care analyzers like the EHBT-25 or EHBT-50. These devices deliver rapid turnaround (6 minutes per sample) while requiring minimal infrastructure.

Mid-Volume Settings (100-300 samples/hour): Regional hospitals and diagnostic centers require analyzers balancing throughput capability with operational simplicity. The EHBT-75 supports 10 samples/hour suitable for district hospital networks and specialized diagnostic centers.

High-Volume Settings (100+ samples/hour): Tertiary care hospitals and reference laboratories operating 24/7 require high-throughput automation, automated sample handling, barcode scanning, and AI-powered diagnostics. These facilities benefit from systems offering comprehensive workflow automation and integration with hospital information systems (HIS) and laboratory information systems (LIS).

HIS/LIS Integration and Data Management

Modern healthcare facilities increasingly require seamless data integration between diagnostic equipment and institutional information systems. Evaluate distributors offering:

Standard Protocol Support: Look for analyzers supporting standard data communication protocols including ASTM, HL7, and alternative technologies such as WiFi, Ethernet, USB, and Bluetooth connectivity. Seamless integration enables automatic result transmission without manual data entry, reducing transcription errors and accelerating result availability to clinicians.

Cloud-Ready Architecture: Advanced analyzers should support cloud-based data management and remote consultation capabilities, enabling access to diagnostic results from any facility location and supporting telehematology consultation for complex cases.

Quality Audit Trails: Comprehensive data management platforms should provide automatic inventory monitoring, batch tracking, expiration management, serial number tracking for regulatory compliance, and detailed quality audit trails supporting regulatory investigations and continuous improvement initiatives.

Applications dans le domaine de la santé

Laboratoires hospitaliers

Hospital laboratories benefit from high-throughput analyzers integrating seamlessly into existing lab workflows. Centralized testing with real-time HIS/LIS connectivity enables rapid result reporting supporting patient care decisions. EHBT-50 or EHBT-75 integration supports comprehensive diagnostic evaluation while reducing equipment footprint.

Cliniques de soins primaires

Point-of-care testing capabilities delivered by compact analyzers like the EHBT-25 or EHBT-50 enable rapid turnaround for common diagnostic panels. Capillary blood sampling requiring only 30 microliters enables fingerstick collection—particularly valuable for pediatric and geriatric populations where venipuncture proves technically challenging.

Cliniques spécialisées

Customized testing panels for specific conditions enable enhanced diagnostic capability without referring specimens to central laboratories. Diabetes clinics benefit from combined HbA1c/glucose/lipid analysis; cardiac clinics from troponin/NT-proBNP assessment; thyroid clinics from comprehensive thyroid function evaluation.

Centres de diagnostic et laboratoires indépendants

High-volume testing environments utilize multi-device deployment for capacity management. Distributor-managed quality assurance programs and extensive training support enable consistent performance across multiple sites.

Soins d'urgence

EHBT-50 placement in emergency departments enables rapid triage testing with immediate availability of critical parameters including CBC, glucose, troponin, and inflammatory markers supporting urgent clinical decision-making.

Conclusion: Strategic Selection of Your Hematology Analyzer Distributor

Selecting the best hematology analyzer distributor represents a strategic investment determining your facility’s diagnostic capabilities for the next decade. The decision extends beyond comparing equipment specifications to evaluating whether potential partners align with your facility’s clinical priorities, operational requirements, and long-term strategic direction.

The global hematology analyzer market is undergoing fundamental transformation driven by AI integration, advanced optical imaging, and distributed diagnostic models. Leading distributors like Ozelle are driving this transformation through innovative technologies, comprehensive product portfolios, and global service infrastructure supporting healthcare facilities across all settings—from primary care clinics to tertiary reference laboratories.

For healthcare administrators, laboratory directors, and procurement specialists, success requires:

- Technical Excellence: Prioritize analyzers with proven diagnostic accuracy, advanced cell morphology analysis, and comprehensive regulatory approvals

- Operational Integration: Select solutions consolidating multiple testing modalities while maintaining maintenance-free operations and low total cost of ownership

- Infrastructure Support: Ensure distributors maintain robust service infrastructure, training programs, spare parts logistics, and regulatory expertise aligned with your geographic market

- Strategic Alignment: Choose partners whose product portfolios and service capabilities align with your facility’s clinical priorities, patient populations, and operational requirements

- Future-Ready Positioning: Select solutions incorporating AI-powered diagnostics and cloud-ready data management enabling continuous improvement as diagnostic science advances

By approaching distributor selection systematically and strategically, healthcare facilities can establish partnerships delivering superior diagnostic quality, operational efficiency, and long-term value creation.

Visiter https://ozellemed.com/en/ to learn more about Ozelle’s comprehensive hematology analyzer solutions and schedule a facility consultation with our diagnostic specialists.