Introduction: Understanding 5-Part Hematology Analyzer Pricing in the Modern Diagnostic Landscape

The complete blood count (CBC) analyzer market has undergone a profound transformation over the past decade. What once required skilled pathologists performing tedious manual microscopy has evolved into fully automated diagnostic systems capable of processing hundreds of samples daily with precision comparable to or exceeding expert human analysis. At the center of this revolution stands the 5-part hematology analyzer—a pivotal technology that bridges the gap between entry-level 3-part systems and premium 7-part platforms, representing approximately 51% of the global hematology analyzer market share in 2025.

For healthcare facility managers, laboratory directors, and procurement officers, understanding 5-part hematology analyzer pricing has become increasingly critical. The global hematology analyzer market, valued at USD 5.31 billion in 2025, is projected to reach USD 8.82 billion by 2032, expanding at a compound annual growth rate (CAGR) of 7.5%. This robust market expansion reflects healthcare systems worldwide prioritizing diagnostic automation, driven by rising disease burden affecting over 1.2 billion people, aging populations, and increasing demand for rapid diagnostic testing in decentralized care settings.

However, the market encompasses dramatic price variations—from compact, economical systems designed for small clinics to advanced, high-throughput platforms serving massive hospital networks. Understanding these pricing tiers, the factors that drive cost differences, and the true total cost of ownership has become essential for making informed capital investment decisions.

The 5-Part Hematology Analyzer: Definition and Market Positioning

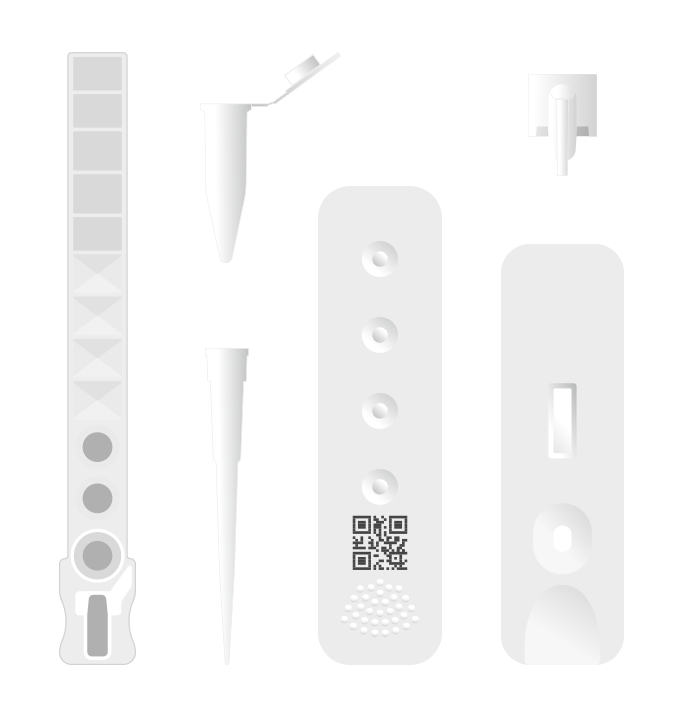

A 5-part hematology analyzer refers to an automated blood cell counting system that performs complete blood count (CBC) testing while differentiating white blood cells into five distinct categories: neutrophils, lymphocytes, monocytes, eosinophils, and basophils. This level of differentiation provides substantially more diagnostic insight than basic 3-part systems (which measure only WBC, RBC, and platelets) while remaining more cost-effective than advanced 7-part analyzers that identify immature cell populations such as neutrophilic band cells (NST) and abnormal morphology markers.

The 5-part differential represents the historical market standard for mid-volume diagnostic facilities. As recently as the 2010s, these systems utilized conventional flow cytometry modules requiring substantial capital investment ($80,000–$150,000+) and occupied significant laboratory footprint. The introduction of LED-based flow cytometers and refined optical technologies approximately a decade ago fundamentally altered this landscape, enabling manufacturers to develop compact, cost-effective 5-part systems suitable for regional hospitals, diagnostic centers, and specialized clinics processing 50–200 samples daily.

Today’s 5-part analyzers incorporate advanced features including autoloader capability, bidirectional laboratory information system (LIS) integration, quality control automation, and increasingly, artificial intelligence-powered morphological analysis that approaches the diagnostic depth traditionally reserved for premium systems.

Global Market Context: Pricing and Market Dynamics

| Market Metric | 2025 Value | 2032 Projection | CAGR |

| Global Hematology Analyzer Market | USD 5.31 billion | USD 8.82 billion | 7.50% |

| Fully Automated Systems (Market Share) | 63.30% | - | - |

| 5-Part Differential Systems (Market Share) | 51% | - | - |

| 7-Part Advanced Systems (Growth Category) | Fastest-growing segment | - | - |

The market’s expansion reflects far more than simple numerical growth—it represents a fundamental paradigm shift in diagnostic methodology. Healthcare systems globally are transitioning from outsourced reference laboratory testing toward decentralized, in-house diagnostics that deliver faster turnaround, reduced per-test costs, and improved patient care delivery. This shift directly influences 5-part analyzer pricing: manufacturers emphasize value propositions centered on operational efficiency, maintenance simplicity, and total cost of ownership rather than lowest entry price alone.

Regional pricing variations reveal interesting market dynamics. In emerging economies like India, 5-part analyzers range from approximately ₹229,000 to ₹870,000 (USD $2,750–$10,450), reflecting entry-level to mid-range market segments serving primary healthcare centers, diagnostic laboratories, and regional hospitals. By contrast, North American pricing for equivalent systems reaches $50,000–$120,000 due to regulatory complexity, premium brand positioning, and the prevalence of high-volume diagnostic centers. This geographic arbitrage creates opportunity: facilities in cost-sensitive markets can access sophisticated 5-part diagnostics at price points that dramatically improve access to quality care.

5-Part Hematology Analyzer Pricing Tiers: Detailed Breakdown

Understanding 5-part analyzer pricing requires examining several distinct market segments, each serving different facility types and operational requirements.

Entry-Level to Mid-Range 5-Part Systems: $30,000–$80,000 USD

The $30,000–$80,000 price range represents the core market segment for 5-part hematology analyzers. Systems positioned in this tier serve regional hospitals, diagnostic centers, and specialized clinics processing approximately 50–200 samples daily. These analyzers typically offer:

- Throughput capacity: 20–70 samples per hour

- Core technology: Combination of impedance-based counting and optical analysis

- Automation level: Fully automated with autoloader capability

- Integration: Bidirectional LIS connectivity, Ethernet, USB, and optional WiFi

- Maintenance: Routine reagent replenishment; minimal service interventions

- Parameters reported: 25–30 parameters including 5-part WBC differential

- Footprint: Compact design (typically 400mm × 320mm × 410mm)

Key Representative Models:

| Manufacturer | Model | Estimated Price Range | Key Features |

| Beckman Coulter | DxH 500 | $50,000–$120,000 | 5-part differential, user-friendly interface, reliable impedance technology |

| Mindray | BC-5150 | $15,000–$40,000 (regional pricing) | 60 samples/hour, tri-angle laser scatter + chemical dye, 25 parameters |

| HORIBA | Pentra 60 C+ | $40,000–$90,000 | Cytochemistry + light absorbency, automated daily checks |

In the Indian market, where 5-part analyzers are particularly prevalent, pricing reflects this tier distinctly:

| Model | Typical Price (INR) | USD Equivalent |

| Mindray BC-5150 | ₹460,000–₹479,000 | $5,520–$5,750 |

| Mindray BC-5130 | ₹479,000 | $5,750 |

| Erba H560 | ₹540,000 | $6,480 |

These price points reflect the true cost-effectiveness of 5-part analyzers for mid-market facilities. A diagnostic center processing 2,000 samples monthly faces dramatically different economic calculus than a high-volume hospital laboratory. For such facilities, a $40,000–$60,000 capital investment amortized over 7 years, combined with per-test consumable costs of $5–$10, generates break-even economics within 3–4 years compared to outsourcing blood analysis to reference laboratories charging $8–$15 per test.

Advanced 5-Part Systems with AI Integration: $60,000–$100,000 USD

An emerging category of 5-part analyzers incorporates artificial intelligence-powered morphological analysis alongside traditional flow cytometry, commanding pricing premiums of 30–50% above conventional 5-part systems but delivering diagnostic capabilities approaching 7-part premium platforms. These systems leverage deep learning algorithms trained on millions of clinical samples to identify subtle morphological abnormalities, improving detection accuracy for leukemia, severe infections, hemolytic anemias, and bone marrow disorders.

Notable examples in this category include:

- Advanced models emphasizing AI-driven cell morphology recognition

- Integration of liquid-based staining technology for enhanced color dimension

- Automated flagging of abnormal cell populations

- Comprehensive 37+ parameter reporting with immature cell identification

- Maintenance-free operation utilizing individual test cartridges

This category represents the intersection of conventional 5-part technology and premium 7-part capabilities, offering laboratories the option to access advanced diagnostics without the full investment required for premium systems.

Comparative Pricing: 5-Part vs. 3-Part and 7-Part Analyzers

Understanding how 5-part systems compare to adjacent technology tiers illuminates pricing logic and value proposition clarity.

| System Type | Differenzielle Fähigkeit | Durchsatz (Proben/Stunde) | Price Range (USD) | Ideal Application | Key Advantage |

| 3-Part Entry-Level | Basic WBC (3 categories) | 10–15 | $15,000–$30,000 | Small clinics, primary care, pharmacies | Affordability, compact footprint, simplicity |

| 5-Part Mid-Range | Standard WBC differentiation | 20–70 | $30,000–$80,000 | Regional hospitals, diagnostic centers | Cost-effectiveness, proven reliability, adequate diagnostic depth |

| 7-Part Premium | WBC + abnormal cells (NST, NSG, NSH, RET) | 60–200+ | $80,000–$150,000+ | Large hospitals, reference labs, research | Advanced morphology, AI integration, maximum diagnostic capacity |

The pricing progression reflects genuine functionality differences rather than arbitrary markup. A 3-part system costs substantially less because it bypasses eosinophil and basophil enumeration, reducing optical complexity and reagent system sophistication. A 7-part system commands premium pricing because advanced morphology recognition and immature cell identification require substantially more sophisticated imaging systems, AI processing, and validation across diverse pathology populations.

The 5-part analyzer occupies the “sweet spot” for facilities requiring balanced diagnostic capability without premium pricing—hence its 51% market share dominance.

Ozelle’s 5-Part Hematology Analyzer Positioning and Pricing Strategy

Ozelle, founded in 2014 with origins in Silicon Valley and now operating global research and manufacturing bases, has established a distinctive market position emphasizing artificial intelligence integration, complete blood morphology (CBM) analysis, and total cost of ownership transparency.

Ozelle’s Product Portfolio Overview

Ozelle’s hematology analyzer lineup spans the complete market spectrum, with particular strength in the 5-part and 7-part differential segments:

| Model | Differenzielle Fähigkeit | Multifunktional | Durchsatz | Key Innovation | Target Market |

| EHBT-25 | 3-teilig | Nur Hämatologie | 12 Proben/Stunde | Compact, entry-level AI + CBM | Small clinics, primary care |

| EHBT-50 | 7-part | CBC + Immunoassay + Biochemistry + Urine/Feces | 10 Proben/Stunde | All-in-one consolidation, multi-functional | Mid-sized hospitals, diagnostic centers |

| EHBT-75 | 7-part | Hematology + morphology | 10 Proben/Stunde | Premium AI morphology, 37+ parameters, advanced abnormality flagging | Large hospitals, reference labs |

| EHVT-50 | 7-part | Veterinary (CBC + Immunoassay + Urine + Fecal) | 8 Proben/Stunde | Veterinary-specific, multi-functional | Veterinary clinics, animal diagnostic labs |

Ozelle’s Competitive Positioning:

Ozelle distinguishes itself through several strategic advantages:

- AI-Powered Complete Blood Morphology (CBM) Recognition

Ozelle’s proprietary algorithm, recognized at the 2022 World Artificial Intelligence Conference (WAIC), has been trained on 40 million clinical samples. This deep learning engine enables accurate cell identification and classification approaching expert pathologist-level precision, with particular strength in identifying:

- Immature neutrophil populations (NST—neutrophilic stab/band cells)

- Hypersegmented neutrophils (NSH) indicating abnormal maturation

- Reticulocytes (RET) identifying young red blood cells

- Abnormal morphologies such as schistocytes, echinocytes, and teardrop cells

- Pathological classifications supporting clinical decision-making

This AI integration provides 5-part equivalent pricing with 7-part diagnostic capability—a significant value proposition for mid-market facilities.

- Multi-Functional Consolidation

The EHBT-50 exemplifies Ozelle’s value strategy by consolidating 4–5 separate instruments (hematology, immunoassay, biochemistry, urine analysis, fecal analysis) into a single platform. This consolidation delivers multiple benefits:

- Reduces capital equipment costs compared to purchasing separate analyzers

- Decreases laboratory footprint by 40–60%

- Simplifies workflow and staff training

- Reduces maintenance complexity and service costs

- Enables tiered testing approaches supporting healthcare system efficiency

For a diagnostic center, replacing separate CBC, immunoassay, and chemistry analyzers with the EHBT-50 represents substantially lower total capital investment while maintaining comprehensive diagnostic capability.

- Wartungsfreier Betrieb

Ozelle systems utilize individual disposable test cartridges stored at room temperature, eliminating:

- Frequent reagent preparation

- Complex maintenance procedures

- Cold-chain management burden

- Cross-contamination risk between sample batches

- Unexpected downtime from equipment failures

This maintenance-free design reduces total cost of ownership by eliminating service calls, consumable waste, and operational disruptions—factors typically underestimated in basic equipment pricing.

- Transparent Pricing and Total Cost of Ownership Modeling

Unlike competitors emphasizing equipment cost alone, Ozelle explicitly breaks down equipment, reagent, and service costs, enabling laboratories to forecast true lifetime expenses rather than facing hidden maintenance surprises. This transparency supports healthcare decision-makers in understanding true value propositions.

Ozelle EHBT-50: Case Study in 5-Part + AI Pricing Strategy

The EHBT-50 represents Ozelle’s flagship mid-market offering, positioned at the intersection of 5-part traditional capability and 7-part advanced technology:

Spezifikationen:

- Differential capability: 7-part + advanced morphology recognition (NST, NSG, NSH, ALY, PAg, RET)

- Parameters reported: 37+ parameters across hematology, immunoassay, biochemistry, urine, and fecal analysis

- Durchsatz: 10 Proben/Stunde

- Sample volume: 30–100 µL (capillary or venous whole blood)

- Technology: AI + Complete Blood Morphology, photoelectric colorimetry, immunofluorescence assay, dry chemistry

- Display: 10.1-inch touch screen with intuitive interface

- Maintenance: Maintenance-free cartridge design

- Communication: LIS/HIS integration via WiFi, Ethernet, USB, Bluetooth

- Dimensions: 400mm × 350mm × 450mm

- Gewicht: 15 kg

Clinical Value Proposition:

The EHBT-50 delivers comprehensive diagnostic capability supporting:

- Infection assessment: NST elevation indicates bone marrow stress; combined with monocyte elevation (MON) suggests acute or chronic infection

- Immune dysfunction detection: Lymphocyte depression (LYM) may indicate viral suppression or immunosuppression

- Anemia classification: RET enumeration, RDW analysis, and advanced morphology enable differentiation of anemias by pathophysiology

- Bone marrow disorders: NSH and immature cell identification support hematologic malignancy screening

- Multi-functional consolidation: Single test run provides hematology, immunoassay, and chemistry results simultaneously

Estimated Pricing Positioning:

Based on market research and Ozelle’s strategic positioning, the EHBT-50 is estimated in the $35,000–$65,000 USD range, reflecting:

- Premium pricing relative to conventional 5-part analyzers due to 7-part capability

- Significant cost savings compared to separate instrument purchases (typical 4-5 device consolidation)

- Competitive positioning with mid-range Beckman Coulter (DxH 500/800) and Mindray (BC-5150) platforms

For facilities consolidating multiple instruments, true cost comparison becomes favorable: replacing a separate CBC analyzer ($20,000), immunoassay analyzer ($25,000), and chemistry analyzer ($20,000) with a single EHBT-50 represents substantial capital savings while improving workflow efficiency.

Factors Influencing 5-Part Hematology Analyzer Pricing

Healthcare facility managers evaluating 5-part analyzer investments benefit from understanding the discrete factors driving pricing variation, enabling more sophisticated purchasing decisions.

1. Automation Level and Sample Processing Complexity

Automation directly correlates with equipment cost. Systems requiring minimal human intervention—fully automated sample loading, staining, processing, and reporting—command premium pricing relative to semi-automated platforms. The EHBT-50’s automated sample processing reduces labor burden but adds optical and mechanical complexity reflected in pricing.

2. Differential Capability and Parameter Depth

Five-part systems report 5-part WBC differentiation plus approximately 20–25 additional parameters (RBC count, hemoglobin, hematocrit, MCV, MCH, MCHC, RDW, platelet count, MPV, etc.). Advanced systems may report 30–40+ parameters including immature cell indices, ratio calculations (NLR, PLR), and abnormal morphology flags. Parameter expansion correlates with optical sophistication and software complexity, influencing pricing.

3. Throughput Capacity

Sample processing speed—measured in samples per hour—drives mechanical and optical system complexity. A system processing 70 samples/hour requires more robust fluid handling, faster optical scanning, and greater processing computational power than a 20-sample/hour platform, justifying pricing premiums of $15,000–$25,000.

4. Technology Platform: Impedance vs. Laser vs. Flow Cytometry

Different optical counting methodologies command different price points:

- Impedance-based technology: Traditional, proven, lowest cost; uses electrical resistance changes as cells pass through counting aperture

- Laser/LED scatter: More sophisticated optical analysis; medium cost tier

- Flow cytometry: Premium laser-based counting with advanced light scatter analysis; highest cost but greatest precision

Ozelle’s approach combines advanced optical morphology imaging with proprietary AI algorithms, positioning systems as premium 5-part alternatives rather than budget entries.

5. AI and Advanced Morphology Recognition

Artificial intelligence integration adds 20–40% pricing premiums but delivers diagnostic capabilities approaching manual microscopic review. Ozelle’s 40-million-sample training database enables accurate morphological abnormality detection that historically required expert pathologists. This capability justifies premium positioning compared to conventional 5-part analyzers.

6. Multi-Functional Consolidation

Systems combining hematology, immunoassay, biochemistry, and ancillary testing (urine, fecal) command 30–50% pricing premiums relative to single-purpose analyzers but deliver dramatic facility cost savings through instrument consolidation. A facility purchasing separate analyzers incurs:

- CBC analyzer: $20,000–$40,000

- Immunoassay analyzer: $25,000–$50,000

- Chemistry analyzer: $20,000–$40,000

- Total capital: $65,000–$130,000

A multi-functional EHBT-50 at $40,000–$65,000 represents 40–70% savings on capital investment while improving space efficiency and simplifying maintenance.

7. LIS Integration and Software Sophistication

Bidirectional laboratory information system connectivity, automated quality control, customizable reporting, OTA (over-the-air) software updates, and AI-supported diagnostic interpretation add software development costs reflected in pricing premiums of $5,000–$15,000 relative to basic systems.

8. Maintenance and Service Model

Maintenance-free design utilizing disposable cartridges reduces long-term service costs but reflects engineering complexity in equipment pricing. Traditional systems with reusable counting chambers and complex fluid paths require frequent maintenance but cost less initially. Total cost of ownership analysis reveals that maintenance-free systems deliver superior economics despite higher initial pricing.

9. Geographic Location and Regulatory Requirements

North American and European systems command pricing premiums reflecting:

- Regulatory compliance (FDA, CE marking)

- Premium brand positioning

- Regional warranty and service infrastructure

- Higher labor costs for manufacturing and support

Emerging market systems in India and Southeast Asia offer equivalent functionality at 40–60% lower pricing due to lower manufacturing and support costs. This geographic arbitrage explains why the same Mindray BC-5150 model may cost $5,500 in India but $15,000–$20,000 in North America.

10. Warranty, Training, and Installation Services

Equipment pricing often varies based on included services:

- Standard packages: Equipment + basic training + 1-year warranty = baseline pricing

- Extended packages: Equipment + comprehensive training + extended warranty + integration support = 15–30% pricing premiums

Healthcare facilities in cost-sensitive markets may negotiate reduced pricing by purchasing equipment only, arranging staff training internally, and handling LIS integration in-house.

Total Cost of Ownership: Beyond Equipment Pricing

Healthcare facility managers making 5-part analyzer purchasing decisions must examine total cost of ownership (TCO) across the equipment’s operational lifetime (typically 7–10 years) rather than focusing exclusively on initial capital investment.

TCO Cost Components

| Cost Category | Entry-Level 5-Part (annual) | Mid-Range 5-Part (annual) | Premium 5-Part+ AI (annual) |

| Equipment (amortized, 7-year) | $2,100 | $5,000 | $8,000 |

| Consumables (500 tests/month) | $3,000 | $4,500 | $5,000 |

| Maintenance & Service | $1,500 | $1,000 | $500 |

| Software/LIS Integration | $200 | $500 | $1,000 |

| Staff Training & Development | $500 | $500 | $800 |

| Quality Control & Calibration | $400 | $400 | $300 |

| Total Annual TCO | $7,700 | $12,000 | $15,600 |

| Cost Per Test (500 tests/month) | $12.83 | $20.00 | $26.00 |

This analysis reveals important insights:

- Maintenance-Free Systems Reduce Long-Term Costs

Ozelle systems utilizing disposable cartridges eliminate major service expenses, shifting cost structure toward consumables. A facility paying $1,000 annually for service calls and $500 for maintenance supply for a traditional 5-part system reduces these expenses to $300–$500 for maintenance-free alternatives.

- Consumable Costs Dominate TCO

For mid-volume facilities processing 500–2,000 monthly tests, consumable costs typically represent 35–50% of total five-year expenditure, equipment representing only 15–25%. This reality shifts purchasing emphasis toward systems with superior consumable economics rather than lowest equipment price.

- Multi-Functional Consolidation Delivers Dramatic Savings

A facility consolidating 3–5 separate analyzers achieves rapid ROI through eliminated equipment investment. Purchasing an EHBT-50 at $50,000 instead of separate CBC ($30,000), immunoassay ($35,000), and chemistry ($25,000) analyzers totaling $90,000 generates $40,000 immediate capital savings. Over seven years, eliminating multiple maintenance contracts and reagent supply chains generates additional savings of $8,000–$15,000 annually.

ROI Analysis: Break-Even and Payback Periods

Understanding return on investment helps healthcare facility managers justify capital expenditures and evaluate financing options.

Small Clinic Scenario: 20–50 Daily Tests

Facility Profile: Private clinic, family medicine practice, urgent care center

Annual Test Volume: 5,000–12,500 tests

Equipment Selection: EHBT-25 (3-part entry-level) or compact 5-part system at $25,000–$35,000

Cost Analysis:

- Equipment cost (amortized): $3,500/year

- Consumables (500 tests/month, $8/test): $4,800/year

- Service: $300/year

- Total annual cost: $8,600/year

- Referral lab cost comparison: $8–$15/test × 12,500 tests = $100,000–$187,500/year

ROI: Equipment pays for itself within 4–5 months compared to reference laboratory outsourcing; facility generates $90,000–$180,000 annual savings thereafter.

Mid-Sized Hospital Scenario: 100–300 Daily Tests

Facility Profile: Regional hospital, diagnostic laboratory, large clinic network

Annual Test Volume: 25,000–75,000 tests

Equipment Selection: EHBT-50 (7-part multi-functional) or mid-range 5-part at $40,000–$65,000

Cost Analysis:

- Equipment cost (amortized over 7 years): $6,000/year

- Consumables (2,500 tests/month, $6/test): $18,000/year

- Service: $500/year

- Total annual cost: $24,500/year

- Referral lab cost comparison: $8–$12/test × 50,000 tests = $400,000–$600,000/year

ROI: Equipment pays for itself within 2 months compared to reference laboratory pricing; facility generates $375,000–$575,000 annual savings thereafter. Multi-functional consolidation of previously separate analyzers further reduces costs by $8,000–$12,000 annually.

Large Hospital Scenario: 500+ Daily Tests

Facility Profile: Large teaching hospital, reference laboratory, high-volume diagnostic center

Annual Test Volume: 125,000+ tests

Equipment Selection: Premium 5-part+ or 7-part system at $60,000–$100,000; often multiple units

Cost Analysis (per analyzer):

- Equipment cost (amortized): $10,000/year

- Consumables (5,000 tests/month, $5/test): $30,000/year

- Service/maintenance: $1,000/year

- Total annual cost: $41,000/year

- Referral lab cost comparison: $6–$10/test × 125,000 tests = $750,000–$1,250,000/year

ROI: Equipment pays for itself within 6–9 weeks compared to reference laboratory pricing; facility generates $700,000–$1,200,000 annual savings per analyzer deployed.

Selecting the Right 5-Part Analyzer: Decision Framework

Healthcare facility managers evaluating 5-part hematology analyzer investments should employ a structured decision framework considering facility characteristics, testing volumes, budget constraints, and future growth projections.

1. Assess Testing Volume and Growth Trajectory

Low-volume facilities (20–100 daily samples):

- Consider entry-level 3-part systems ($15,000–$30,000) if budget-constrained

- Evaluate mid-range 5-part systems ($30,000–$50,000) if comprehensive diagnostic capability is required

- ROI payback period: 4–5 years

Mid-volume facilities (100–500 daily samples):

- Target mid-range to premium 5-part systems ($40,000–$80,000)

- Consider multi-functional consolidation if separate analyzers are currently deployed

- ROI payback period: 2–3 years

High-volume facilities (500+ daily samples):

- Deploy multiple premium analyzers or high-throughput systems

- Prioritize total cost of ownership and per-test economics over equipment cost

- ROI payback period: 6–12 weeks

2. Evaluate Current Laboratory Infrastructure

Single-purpose laboratory (hematology-only focus):

- Traditional 5-part analyzer optimally suited

- Prioritize throughput, reliability, and consumable economics

Multi-functional laboratory (CBC + chemistry + immunoassay):

- Multi-functional consolidation systems (EHBT-50) deliver dramatic ROI through instrument replacement

- Evaluate space savings and workflow optimization benefits

Decentralized point-of-care testing:

- Compact, portable 5-part systems preferred

- Maintenance-free operation essential for non-laboratory personnel

3. Prioritize Total Cost of Ownership Over Equipment Price

Calculate lifetime costs across 7–10 year operational horizon including:

- Equipment amortization

- Consumable costs at anticipated test volumes

- Maintenance and service costs

- Staff training investments

- Software and integration expenses

A system costing $20,000 more initially but delivering $5,000/year consumable savings over seven years generates net savings of $15,000—often overlooked in budget-focused purchasing decisions.

4. Assess Technology and AI Integration Value

Evaluate whether AI-powered morphology recognition justifies pricing premiums through:

- Reduced reflex testing (manual microscopy review) costs

- Improved detection accuracy for pathological conditions

- Clinical decision support value

- Operator training requirements and learning curve

For hospitals processing high volumes of pediatric, oncology, or infectious disease cases, AI integration may deliver substantial diagnostic and economic value.

5. Examine Maintenance Requirements and Service Infrastructure

Compare:

- Maintenance-free systems (higher equipment cost, lower TCO)

- Traditional systems (lower equipment cost, higher maintenance burden)

- Regional service infrastructure and support response times

- Warranty coverage and upgrade pathways

6. Evaluate Vendor Selection Based on Support and Longevity

Established manufacturers (Beckman Coulter, Sysmex, HORIBA, Mindray) offer proven reliability and established service networks. Innovative newer vendors (Ozelle, Seamaty) emphasize cutting-edge technology and cost-effectiveness but warrant assessment of long-term viability and support availability.

Ozelle’s Market Differentiation: Why Pricing Represents Value

Ozelle has carved a distinctive market position by emphasizing several value drivers beyond equipment cost alone:

1. AI-Powered Morphology at Mid-Range Pricing

Ozelle’s 40-million-sample training database and WAIC-recognized algorithms deliver 7-part diagnostic capability at 5-part pricing. This represents genuine innovation: laboratories no longer face a binary choice between affordability (3-part) and advanced diagnostics (expensive 7-part systems). The EHBT-50 bridges this gap.

2. Multi-Functional Consolidation Reducing Total Equipment Spending

By combining CBC, immunoassay, biochemistry, and ancillary testing, the EHBT-50 eliminates separate instrument purchases generating $20,000–$40,000 capital savings for multi-functional laboratories. This consolidation benefit often justifies higher per-unit equipment cost relative to single-purpose analyzers.

3. Maintenance-Free Operation Reducing Hidden Costs

Disposable cartridge design eliminates reagent preparation, reduces service call frequency, and minimizes unexpected downtime. For facilities where laboratory automation disruptions directly impact patient care delays, maintenance-free operation delivers non-financial benefits justifying premium pricing.

4. Proven Global Presence: 50,000 Units, 40 Million Clinical Samples

Ozelle has deployed 50,000 analyzers globally, generating clinical validation across 40 million diagnostic samples. This installed base provides confidence regarding reliability, performance consistency, and long-term support viability—factors often overlooked in pricing discussions but critical for equipment decisions spanning 7–10 years.

Ozelle’s installations span hospitals, diagnostic laboratories, clinics, pharmacies, and veterinary practices across Asia, Europe, North America, and emerging markets, reflecting diverse use case validation.

5. Transparent Pricing and Total Cost of Ownership Honesty

Unlike competitors emphasizing equipment cost alone, Ozelle explicitly breaks down consumable, maintenance, and support costs, enabling transparent ROI calculations. This transparency supports healthcare decision-making and builds confidence regarding value propositions.

Market Trends Influencing 5-Part Hematology Analyzer Pricing

Understanding broader market trends helps healthcare facilities anticipate future pricing dynamics and technology evolution.

1. AI Integration as Standard Rather Than Premium Feature

Artificial intelligence-powered morphology recognition is transitioning from premium differentiation toward market standard. As more manufacturers integrate AI capabilities, pricing for AI-enhanced systems is declining. Facilities purchasing in 2025–2026 benefit from competitive pricing on systems that would have commanded 30–50% premiums three years ago.

2. Decentralization of Laboratory Testing

Healthcare systems are shifting toward point-of-care and decentralized testing, reducing reliance on centralized reference laboratories. This trend increases demand for portable, maintenance-free, and user-friendly 5-part analyzers suitable for non-laboratory settings (clinics, pharmacies, emergency departments). Manufacturers emphasizing simplicity and autonomy command favorable market positioning.

3. Integration with Laboratory Information Systems and Digital Health

Modern hematology analyzers function as nodes within broader laboratory information ecosystems. Systems offering robust LIS integration, cloud connectivity, and data analytics capabilities command pricing premiums reflecting infrastructure value. Facilities prioritizing digital health transformation may justify higher equipment costs for superior integration capabilities.

4. Expanded Assay Menus Through Software Updates

Over-the-air (OTA) software updates enable existing analyzers to access expanded testing menus without hardware modifications. This capability reduces equipment obsolescence risk and extends product lifecycles, justifying investment in systems supporting OTA expansion. Ozelle’s commitment to OTA updates exemplifies this trend.

5. Sustainability and Waste Reduction

Healthcare organizations increasingly prioritize equipment generating minimal waste. Maintenance-free, disposable cartridge systems reduce reagent waste and chemical handling compared to traditional systems with complex fluid paths. This environmental alignment, while not directly affecting equipment pricing, influences institutional purchasing preferences.

Conclusion: Making Informed 5-Part Hematology Analyzer Investment Decisions

The 5-part hematology analyzer market in 2025 presents healthcare facility managers with unprecedented opportunity: sophisticated diagnostic technology, cost-effective compared to reference laboratory outsourcing, and increasingly available with AI-powered morphological analysis that approaches manual microscopic expertise.

Pricing for 5-part systems ranges broadly—$30,000–$80,000 USD for conventional platforms, with premium AI-integrated systems commanding $60,000–$100,000 USD. This variation reflects genuine differences in automation, throughput, multi-functional capability, and advanced diagnostics rather than arbitrary markup.

Key takeaways for healthcare decision-makers:

- Focus on Total Cost of Ownership, Not Equipment Price Alone

Consumable costs typically dominate lifetime expenses. A system costing $15,000 more initially but delivering $5,000/year savings in consumables and maintenance generates superior long-term economics.

- Evaluate Multi-Functional Consolidation Benefits

For facilities operating separate hematology, immunoassay, and chemistry analyzers, multi-functional systems (like Ozelle’s EHBT-50) may deliver $30,000–$50,000 capital savings while improving efficiency.

- Assess AI and Advanced Morphology Value in Your Clinical Context

For hospitals managing high volumes of oncology, pediatric, or infectious disease cases, AI-powered morphology recognition delivers diagnostic and operational benefits justifying premium pricing. For routine screening clinics, standard 5-part capability may suffice.

- Validate Long-Term Vendor Support and Viability

Equipment decisions span 7–10 years. Established manufacturers (Beckman Coulter, Sysmex, HORIBA, Mindray) offer proven support infrastructure. Innovative vendors (Ozelle, with 50,000 global installations and 40-million-sample validation) warrant consideration but warrant assessment of support commitment.

- Calculate ROI Based on Your Facility’s Testing Volume

Break-even economics vary dramatically: high-volume facilities achieve payback within weeks compared to reference laboratory outsourcing; low-volume facilities require 4–5 years. Ensure projected test volume growth justifies equipment investment.

The global hematology analyzer market’s 7.5% CAGR expansion indicates that automated blood diagnostics represent healthcare’s future. By understanding 5-part analyzer pricing, total cost of ownership factors, and your facility’s specific requirements, healthcare decision-makers can invest with confidence, knowing they’ve selected technology delivering optimal value across the equipment’s operational lifetime.

For detailed consultation regarding 5-part hematology analyzer selection, pricing, and ROI analysis specific to your facility’s requirements, contact https://ozellemed.com/en/. Ozelle’s regional distributors provide transparent quoting and customized recommendations reflecting your testing volume, facility type, and integration requirements.