I. Introduction: The Emerging Market Diagnostic Crisis

The global healthcare landscape faces a profound paradox: billions of people in emerging markets lack access to basic diagnostic infrastructure. Over 1.2 billion people worldwide are affected by anemia, yet diagnostic capacity remains critically inadequate. India has only 0.9 hospital beds per 1,000 population compared to Germany’s 7.8 beds per 1,000. Beyond infrastructure, a global technician shortage constrains diagnostic capacity expansion at precisely the moment when testing demand accelerates.

The emerging markets opportunity is equally compelling. The Asia-Pacific region is projected for 8.2% CAGR hematology analyzer adoption through 2034. This growth reflects structural recognition that AI-powered diagnostic systems can bypass traditional infrastructure limitations, democratizing access to expert-level diagnostics across geographies and income levels.

AI-powered Complete Blood Count (CBC) analyzers represent the strategic intervention point for addressing this crisis. These systems transform diagnostic capability from centralized, specialist-dependent processes into scalable, accessible solutions deployable across primary care clinics, rural facilities, pharmacy networks, and distributed healthcare models.

II. The Emerging Markets Opportunity: Market Landscape

The global hematology analyzer market stands at an inflection point. Valued at USD 4.33 billion in 2025, the market is projected to reach USD 7.28 billion by 2034, expanding at 5.97% CAGR. This expansion signals a fundamental restructuring of diagnostic delivery from hospital-centric to distributed, from specialist-dependent to accessible.

Emerging markets represent the fastest-growing segment. Country-specific growth rates reveal magnitude of opportunity: China projects 7.2% CAGR, India 6.7% CAGR, with Southeast Asian nations experiencing similarly explosive adoption. This acceleration reflects primary healthcare expansion and government-led Universal Health Coverage initiatives, not mature healthcare system upgrades.

Regional healthcare system characteristics define distinct market dynamics. Southeast Asia combines rapid urbanization with distributed primary healthcare models, creating ideal conditions for point-of-care diagnostics. South Asia experiences government-led UHC expansion requiring diagnostic infrastructure at scale, where cost-effective solutions aligned with procurement processes unlock market access. Latin America’s mixed public-private healthcare model leverages pharmacy-based testing and diagnostic networks as alternative distribution channels.

III. Understanding Localization: Beyond Translation to Market Adaptation

Effective emerging market strategy extends across five critical dimensions, each requiring systematic adaptation. True localization is not translation—it is comprehensive redesign across regulatory, clinical, operational, and distribution dimensions.

Regulatory & Compliance forms the foundational dimension. India’s CDSCO registration requires proof of home-market approval, comprehensive technical documentation, and manufacturing facility registration, with timelines of 6-9 months. China’s NMPA demands Chinese language documentation and clinical data from Chinese population cohorts, with UDI framework compliance. ASEAN countries each maintain independent regulatory authorities: Malaysia, Thailand, and Singapore operate on 45-80 working day timelines for properly submitted devices.

Language & UI Localization extends beyond interface translation. Clinical terminology varies across regions based on disease prevalence patterns and clinical norms. Culturally adapted instructions, multilingual support, and clinically relevant display options ensure non-specialist staff can operate systems reliably.

Clinical & Diagnostic Standards requires algorithmic adaptation grounded in population science. Diagnostic reference ranges are population-specific, varying by altitude, ethnicity, and endemic disease patterns. AI algorithms must be trained on regional cohorts to ensure accuracy for local populations.

Operational Adaptation addresses infrastructure realities. Power inconsistencies, connectivity limitations, and maintenance constraints require maintenance-free operation, offline-first architecture, and room-temperature storage of consumables.

Distribution & Support infrastructure determines market accessibility through local partnership networks, regional training centers, and technical support infrastructure.

IV. Ozelle’s Emerging Market Localization Strategy: The Tiered Portfolio

Ozelle’s approach demonstrates sophisticated product-level localization aligned with regional deployment realities. The tiered portfolio strategically maps to distinct market segments and healthcare facility types.

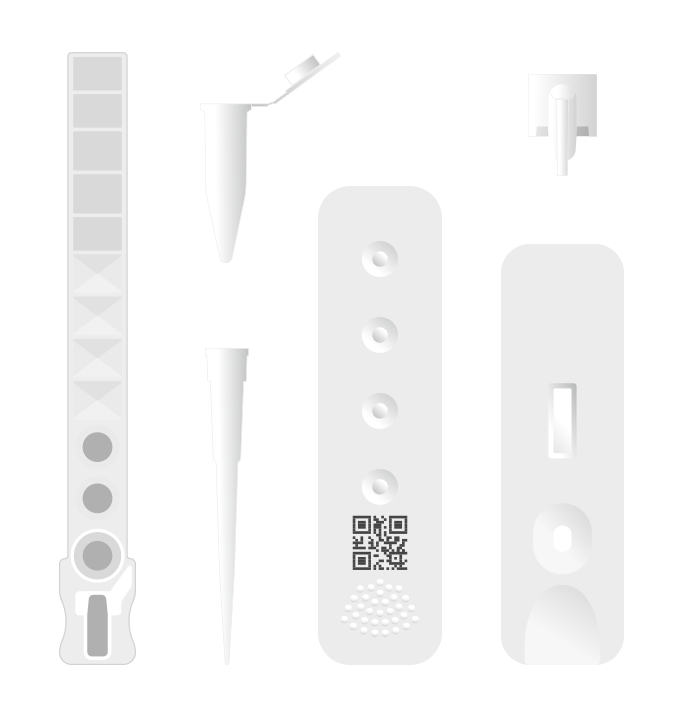

The EHBT-25: Entry-Level Solution targets expanding primary healthcare clinic networks across Southeast Asia and South Asia. Weighing 8.1 kilograms with compact dimensions, it deploys where space constraints and mobility requirements necessitate minimal footprint. The 3-diff CBC capability balances clinical value against cost—providing essential leukocyte differentiation for infections, anemia, and common hematologic disorders. Offline capability with cloud synchronization enables operation in clinics with unreliable connectivity. Minimal training requirements enable staff with limited laboratory experience to generate reliable results, addressing technician shortage constraints.

The EHBT-75: Mid-Tier Platform positions itself for district hospitals and mid-sized diagnostic laboratories requiring deeper clinical insight. The 7-diff AI-powered morphology expands diagnostic capability to include abnormal cell detection: neutrophilic stab granulocytes (NST), segmented granulocytes (NSG), hypersegmented neutrophils (NSH), and reticulocytes (RET). Advanced AI trained on diverse population samples delivers accuracy approaching pathologist-level analysis while maintaining operational simplicity. The system processes samples in six minutes, dramatically faster than manual microscopy, creating fundamental workflow advantages.

The EHBT-50 Comprehensive Mini-Lab combines 7-diff hematology, immunoassay, biochemistry, urine, and feces testing into a single integrated platform. This directly addresses emerging market reality: capital expenditure constraints and space limitations. The all-in-one design reduces equipment footprint while centralizing sample processing.

Geographic customization strategies embed regional deployment realities directly into commercialization planning. Southeast Asia emphasizes primary healthcare expansion compatibility and multilingual support. South Asia aligns with UHC government procurement processes and regional language support. Latin America emphasizes hospital network integration and pharmacy-based testing enablement.

V. Regulatory & Standards Compliance: Navigating Emerging Market Requirements

Emerging market regulatory navigation requires simultaneous engagement across multiple frameworks. Ozelle’s compliance roadmap demonstrates how CE and FDA certifications serve as foundation enabling efficient pursuit of region-specific registrations.

India’s CDSCO Registration demands proof of home-market regulatory approval. Technical documentation must be submitted for expert review. Manufacturing facility registration with GMP compliance verification is mandatory, with ISO 13485:2016 certification required. Registration timelines typically extend 6-9 months for Class C/D devices.

China’s NMPA Approval requires Chinese language documentation and clinical validation data from Chinese population cohorts. NMPA increasingly prioritizes innovative products through priority review status. The UDI framework applies to all devices, with implementation extending through 2029.

ASEAN Requirements present harmonized framework through ASEAN Medical Device Directive, though individual countries maintain independent regulatory authorities. Malaysia, Thailand, and Singapore operate on 45-80 working day review timelines for properly submitted Class B-D devices. The Common Submission Dossier Template standardizes documentation across nations.

Mexico’s COFEPRIS Registration enables Latin American market access with FDA-similar framework requiring Spanish language documentation and local manufacturing representative designation.

Ozelle’s compliance strategy leverages CE and FDA certifications as foundation while pursuing region-specific registrations in phased approach. Year one focuses on India CDSCO and key ASEAN markets, establishing presence in fastest-growing regions. Year two expands to China NMPA and additional ASEAN markets. Year three pursues Mexico COFEPRIS enabling systematic Latin American expansion.

VI. Building Local Distribution Networks: Partnerships & Channels

Market access in emerging markets requires deliberate construction of multi-channel distribution infrastructure adapted to regional healthcare delivery models.

Direct Distribution Through Established Medical Device Distributors leverages existing relationships with hospitals and diagnostic labs. Distributor selection emphasizes market presence, service infrastructure, regulatory expertise, and training capacity. Leading distributors maintain relationships with government healthcare systems, private hospital chains, and diagnostic lab networks critical for emerging market penetration. Service capability determines whether distributors maintain technician networks supporting installations and staff training. Regulatory expertise helps customers navigate device selection and compliance requirements.

Government Procurement Channels represent enormous opportunity in UHC expansion. India’s government health system and Southeast Asian systems operate through centralized tender processes favoring locally-relevant pricing and total-cost-of-ownership clarity. Successful procurement requires understanding distinct agency timelines, documentation requirements, and approval processes.

Pharmacy-Based Testing Partnerships represent rapidly expanding channels in select markets. Indonesia increasingly permits pharmacy-based clinical testing, creating deployment opportunities in pharmacy networks reaching smaller towns and rural areas. This channel requires compact design, minimal training requirements, and attractive per-test economics supporting pharmacy margins.

Hospital Network Partnerships enable scaled deployment across multi-unit healthcare systems. Major hospital chains increasingly operate integrated laboratory networks serving multiple facility tiers. Analyzer portfolio alignment enables system-wide standardization: premium EHBT-50 systems centralize advanced testing, EHBT-75 units support district hospital networks, and EHBT-25 systems extend diagnostic capability to clinic networks.

Distributor support infrastructure extends beyond device supply to encompass training programs, technical support protocols, spare parts logistics, and ongoing staff development. Regional training centers positioned to support distributor networks prove more effective than centralized training.

VII. Emerging Market Success Stories: Proof of Concept

Ozelle’s global deployment experience demonstrates emerging market viability and achievable impact through systematic localization. The company has deployed 50,000+ units globally serving 40+ million patient samples annually, with point-of-care segment growth outpacing centralized laboratory growth at 5.8% CAGR.

Rural Clinic Networks in Southeast Asia implementing Ozelle technology demonstrate turnaround time transformation. Traditional workflow—collecting blood samples, storing overnight or using expensive transport to centralized laboratories, and returning results 3-4 days later—deferred clinical diagnosis by days. EHBT-25 deployment at clinic level enables same-day diagnosis, dramatically accelerating clinical decision-making for acute infections, anemia-related symptoms, and other acute conditions requiring rapid CBC assessment. This acceleration improves clinical outcomes by enabling timely treatment initiation.

Indian District Hospital Expansion demonstrates capacity enhancement without proportional cost or staffing increases. A district hospital serving 500,000+ population deployed EHBT-50 mini-lab replacing separate systems while expanding testing menu. Throughput increased 40% without additional laboratory staff—automation replacing manual processes while AI-driven morphology reduced technician dependency.

Latin American Diagnostic Network Extension illustrates geographic reach expansion through innovative distribution. Pharmacy-based testing networks in underserved regions deployed compact analyzers enabling communities without dedicated diagnostic labs to access quality testing locally, eliminating necessary travel for basic diagnostics. This geographic extension improves healthcare access while creating revenue streams for pharmacy networks.

VIII. Addressing Barriers to Adoption in Emerging Markets

Success requires systematic identification and resolution of adoption barriers constraining market penetration.

Cost Barriers historically excluded advanced diagnostics from resource-constrained settings. Premium hematology analyzers commanding $50,000-100,000+ initial expenditure created insurmountable barriers for clinics operating on smaller annual budgets. Ozelle’s tiered portfolio addresses cost through three mechanisms: entry-level EHBT-25 pricing targets primary healthcare budgets, flexible financing distributes capital cost across years, and consumable-based revenue models create sustainable relationships generating ongoing revenue through test kit sales.

Lack of Expertise constrains adoption because advanced diagnostics traditionally required significant technician training and maintenance. Ozelle’s maintenance-free design eliminates specialist technician dependency—individual disposable cartridges eliminate pipelines and moving parts requiring maintenance. One-button operation enables staff with limited laboratory background to generate reliable results. Regional training partnerships create sustainable knowledge-transfer without creating ongoing vendor technician dependency.

Connectivity Limitations prevent cloud-dependent systems from functioning in facilities with unreliable internet. Ozelle’s offline-first architecture enables operation in connectivity-limited environments with batch synchronization—devices store results locally and automatically upload when connection resumes.

Regulatory Uncertainty in emerging markets creates risk deterring new market entrants. Distinct frameworks and unclear timelines create planning difficulty. Ozelle’s in-country regulatory expertise and proactive engagement reduce uncertainty and accelerate market access.

Building Credibility through clinical validation partnerships, peer endorsements, and international certification visibility addresses skepticism concerning quality and reliability. Clinical studies demonstrating accuracy across diverse populations strengthen credibility more effectively than marketing claims alone.

IX. The Role of AI in Localizing Diagnostics

Artificial intelligence fundamentally enables emerging market diagnostic democratization beyond what traditional technology platforms can achieve. AI’s localization advantages extend far beyond efficiency improvement to encompass population-specific accuracy improvement.

The Foundation: 40 Million Sample Training Dataset represents unprecedented scale in blood cell imaging. Ozelle’s “Expert Brain” algorithm trained on 40 million diverse patient samples (recognized at the WAIC 2022 provides foundation enabling systematic expansion with emerging market population cohorts. This massive baseline dataset already incorporates significant population diversity.

Regional Expansion: Emerging Market Cohort Integration directly improves algorithm performance for target populations. Endemic disease patterns—malaria affecting sub-Saharan Africa and Southeast Asia, hookworm parasites across South Asia, tuberculosis endemic across India—create specific cellular morphology patterns distinct from developed-country experience. Altitude effects on hemoglobin and red cell indices affect accuracy in mountainous regions. Genetic variation affects hemoglobin genetics and red cell indices creating population-specific reference ranges. Systematic incorporation of emerging market data improves accuracy specifically for populations served.

Continuous Algorithm Improvement Without Device Replacement represents critical advantage in resource-constrained settings. Traditional platforms require hardware replacement to access new capabilities. AI-enabled systems improve through software updates—devices deployed years ago continue improving through over-the-air algorithm enhancements, dramatically extending product lifecycle and cost-effectiveness.

Accessible Expert-Level Diagnostics for Non-Specialist Staff enables diagnostic decentralization previously impossible. Pathologist expertise becomes encoded in algorithms and accessible to primary care clinic staff, democratizing access to sophisticated diagnostics.

Conclusion: Toward Diagnostic Equity in Emerging Markets

The emerging markets diagnostic crisis represents both infrastructure challenge and systemic healthcare inequity. Yet this crisis simultaneously represents opportunity for transformation through deliberately localized, strategically deployed innovation.

AI-powered complete blood count analyzers embody healthcare democratization—sophisticated diagnostics becoming accessible across geographies and economic circumstances. By combining expert-level accuracy with operational simplicity, scalable deployment, and emerging market-adapted design, these systems transform diagnostic accessibility.

Ozelle’s comprehensive localization strategy—tiered product portfolio, region-specific regulatory pathways, multi-channel distribution networks, population-adapted AI algorithms, and systematic barrier resolution—demonstrates that healthcare companies can profitably serve underserved emerging markets. Success requires abandoning one-size-fits-all approaches in favor of sophisticated adaptation across regulatory, clinical, operational, and distribution dimensions.

The next decade will reveal whether emerging markets close diagnostic infrastructure gaps or allow inequities to widen. The technology and strategic frameworks enabling equity exist. The question is whether healthcare organizations will deploy them systematically.