Executive Summary

The global blood test machine market is experiencing unprecedented transformation. Valued at USD 4.33 billion in 2025, the hematology analyzer market is projected to reach USD 7.28 billion by 2034, expanding at a compound annual growth rate (CAGR) of 5.97%. This explosive growth reflects a fundamental shift in diagnostic methodology—from manual blood analysis and traditional laboratory infrastructure toward fully automated, AI-powered systems that combine speed, accuracy, and unprecedented accessibility.

The convergence of artificial intelligence, complete blood morphology (CBM) technology, and integrated diagnostic platforms is redefining how healthcare systems approach blood testing. Whether serving bustling metropolitan hospitals, remote clinics, or veterinary practices, modern blood test machines now deliver lab-grade precision in minutes rather than hours—with minimal technical expertise required.

The Market Landscape: Size, Growth, and Opportunity

Global Market Valuation and Forecast

The blood test machine market comprises multiple interconnected segments:

- Hematology Analyzer Market: USD 4.33 billion (2025) → USD 7.28 billion (2034), CAGR 5.97%

- Blood Testing Market (Broader): USD 113.30 billion (2025) → USD 210.96 billion (2034), CAGR 7.16%

- Fully Automatic Blood Cell Analyzer Segment: USD 1.1 billion (2025) → USD 1.9 billion (2035), CAGR 5.4%

North America currently dominates with approximately 41% of the market share, driven by advanced healthcare infrastructure and strong adoption of automated diagnostics. However, Asia-Pacific is emerging as the fastest-growing region, with countries like China (7.2% CAGR), India (6.7% CAGR), and Southeast Asian nations leading expansion.

Key Market Drivers

1.Disease Burden and Preventive Healthcare

Over 1.2 billion people worldwide are affected by anemia alone. Combined with rising prevalence of chronic diseases—diabetes, cardiovascular disease, and autoimmune conditions—demand for routine blood testing has never been higher. Healthcare systems increasingly prioritize preventive screening and complete blood count (CBC) testing, creating robust demand for efficient analyzing equipment.

2.Diagnostic Decentralization

Healthcare is shifting away from centralized reference laboratories toward point-of-care testing (POCT) in clinics, pharmacies, emergency departments, and ambulatory care settings. This decentralization trend drives demand for compact, cost-effective analyzers that deliver laboratory-quality results at distributed healthcare touchpoints.

3.Laboratory Technician Shortages

Global shortages of qualified laboratory technicians constrain diagnostic capacity. Fully automated blood analyzers with intuitive interfaces enable non-specialist staff to operate systems reliably, reducing dependence on experienced pathologists for routine testing.

4.Healthcare Infrastructure Expansion

Rapid healthcare modernization in emerging markets creates massive opportunities. Governments in India, Southeast Asia, Africa, and Latin America are investing heavily in diagnostic capabilities—a trend accelerating adoption of scalable, affordable blood test machines.

Product Segmentation: Understanding Market Categories

By Analytical Method

Fully Automated Hematology Analyzers (63.3% market share, 2025)

These systems dominate the market due to superior efficiency, reduced human error, and high-throughput processing. Traditional impedance-based analyzers remain widespread, though flow cytometry and AI-enabled morphology systems represent the fastest-growing segment.

Flow Cytometry-Based Systems (46% market share, 2024)

Advanced flow cytometry platforms offer richer diagnostic data, particularly for identifying abnormal cell morphology and subtle pathological changes. These systems command premium pricing but deliver superior diagnostic depth.

AI & Machine Learning Integration (Fastest-growing segment, 2025-2034)

Artificial intelligence is fundamentally reshaping blood analysis. Rather than simple cell counting, AI-powered systems now combine machine vision with deep learning algorithms to identify cell types, morphology, and clinical significance with expert-level accuracy.

By Test Scope

5-Part Differential Analyzers (51% market share, 2024)

These analyzers—providing detailed leukocyte profiling—represent the market standard. They strike an optimal balance between cost and diagnostic performance, making them the default choice for mid- to high-volume laboratories worldwide.

6-Part and High-End Analyzers (Fastest-growing category, 2025-2034)

Premium systems offering richer diagnostic data are gaining share as clinical care becomes more complex and emerging-market laboratories expand operations.

Integrated Multi-Functional Systems

The most innovative segment combines hematology, immunoassay, biochemistry, and sometimes hemostasis analysis into single platforms. These integrated systems reduce instrument footprint, streamline workflows, and consolidate multiple testing functions into unified solutions.

By Application

Complete Blood Count (CBC) – 58% market share

CBC remains the most frequently ordered blood test globally, driving consistent demand for reliable, efficient analyzers.

Coagulation & Platelet Studies (Fastest-growing application)

Rising awareness of bleeding disorders and thrombotic conditions is accelerating adoption of specialized coagulation analyzers.

Technology Innovation: The AI-Powered Revolution

Complete Blood Morphology (CBM): Beyond Simple Cell Counting

Traditional blood analyzers count cells. Modern AI-powered systems understand cells. Ozelle’s proprietary CBM technology exemplifies this transformation:

- Expert Brain: AI algorithms trained on 40+ million patient samples

- Precision Eyes: Swiss-engineered optical systems with 4-megapixel resolution at 50 frames-per-second

- Technician Hands: Fully automated mechanical arms with <1 micrometer repeatability accuracy

The result? Seven-part differential blood cell classification with morphological abnormality detection—approaching pathologist-level accuracy while eliminating manual slide review and subjective interpretation.

Key Technological Breakthroughs

1.Automated Sample Processing

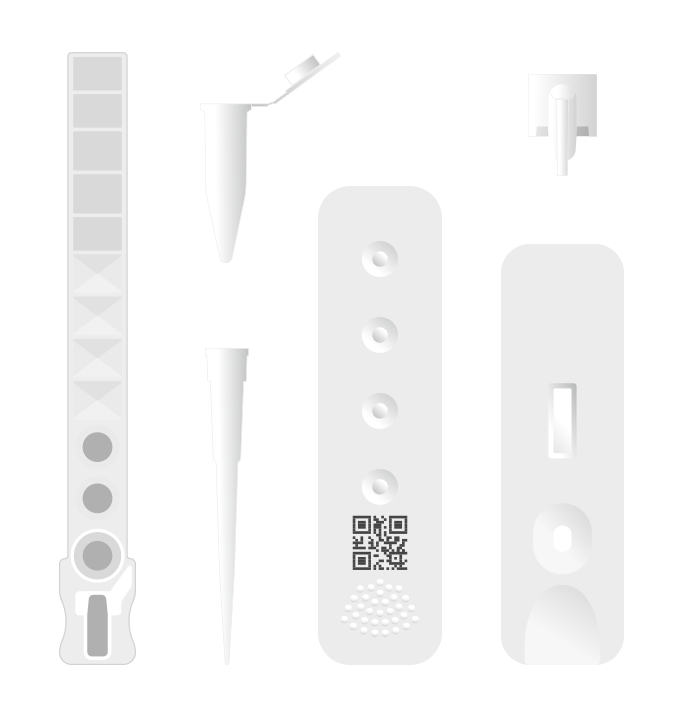

Modern analyzers eliminate manual pipetting and slide preparation. Single-use disposable cartridges containing sealed reagents require only 30–60 microliters of blood. Results arrive in 6 minutes or less.

2.Multi-Parameter Testing

Integrated platforms now deliver 37+ parameters from a single sample:

- Hematology: CBC with 7-part differential

- Immunoassay: Inflammation markers (CRP, SAA), cardiac biomarkers, hormones

- Biochemistry: Glucose, lipids, kidney function, liver function

- Urinalysis and fecal analysis capabilities

3.Maintenance-Free Operation

Disposable cartridge design eliminates pipelines, reducing contamination risk and technical maintenance. No calibration, no cleaning solutions required—a dramatic operational simplification compared to legacy systems.

4.Room-Temperature Stability

Single-use test kits maintain stability at room temperature for extended periods, simplifying supply chain logistics and enabling deployment in resource-constrained settings without cold-chain infrastructure.

Market End-Users: Who’s Buying?

Hospital Laboratories (42% market share)

Hospitals account for the largest end-user segment. High-throughput analyzers processing 10–100+ samples hourly are essential for managing diagnostic volume in tertiary care centers.

Diagnostic and Reference Laboratories (Largest end-use industry, 60% revenue share)

Third-party diagnostic labs and reference centers drive consistent, high-volume demand. These facilities prioritize throughput, accuracy, and multi-parameter capability.

Clinics and Physician Offices (Fastest-growing end-user segment, 2025-2034)

Point-of-care settings increasingly deploy compact, user-friendly analyzers. Primary care clinics, occupational health centers, and urgent care facilities leverage POCT to accelerate clinical decision-making and reduce turnaround time.

Pharmacies & Retail Healthcare Settings

Progressive regulatory frameworks in Brazil, France, USA, Australia, and other countries now permit pharmacies to conduct medical testing—opening new distribution channels for blood analyzers.

Veterinary Practices (Underserved, high-growth opportunity)

The USD 3+ billion global veterinary diagnostics market represents significant expansion opportunity. Companion animal hospitals, large animal practices, and zoo medicine centers increasingly adopt dedicated or multi-functional veterinary analyzers.

Market Trends Shaping the Next Decade

Decentralization of Laboratory Services

Healthcare systems continue shifting diagnostics from centralized labs to distributed point-of-care settings. Compact analyzers enabling bedside testing, clinic-based diagnostics, and pharmacy screening support this structural transformation.

Implication: Highest growth opportunities lie in portable, easy-to-operate, maintenance-free systems suitable for non-laboratory environments.

AI Integration as a Competitive Differentiator

AI and machine learning integration represents the fastest-growing technology segment (2025-2034). Healthcare facilities recognize AI’s value in:

- Improving accuracy and reducing subjectivity

- Enabling predictive analytics for early disease detection

- Reducing manual review time by >50%

- Supporting tiered testing workflows

Implication: AI-powered morphology analysis is rapidly becoming table-stakes rather than premium differentiation.

Integrated Testing Platforms

Rather than purchasing separate instruments for hematology, chemistry, immunoassay, and urinalysis, healthcare networks increasingly prefer consolidated platforms offering:

- Simplified procurement processes

- Reduced instrument footprint

- Single-point vendor relationship

- Optimized workflow efficiency

Implication: Multi-functional integrated analyzers command premium pricing and represent highest-margin products.

Emerging Market Expansion

Diagnostic infrastructure development in Southeast Asia, Africa, South America, and Eastern Europe creates substantial opportunities. Wholesale pricing models and scalable products specifically designed for resource-constrained environments drive rapid adoption.

Implication: Tiered product portfolios (entry-level compact systems + premium integrated platforms) maximize addressable market across income levels.

Telehealth and Remote Diagnostics Integration

Digital pathology and telemedicine integration enable expert consultation from remote locations. Full-field digital morphology imaging allows pathologists worldwide to review complex cases—expanding diagnostic reach to underserved regions.

Competitive Landscape and Market Leaders

Established Players

Sysmex Corporation (Japan)

- Market leader in automated hematology

- Strong presence in Asia-Pacific and North America

- Extensive patent portfolio in automation and microfluidics

Beckman Coulter (USA)

- Dominant in high-throughput hospital laboratory segment

- Premium-priced platforms with advanced capabilities

- Strong hospital relationships and reimbursement infrastructure

Abbott Laboratories (USA)

- Broad diagnostic portfolio including point-of-care systems

- Strong distribution network and brand recognition

- Significant R&D investment in AI integration

Siemens Healthineers (Germany)

- Integrated laboratory solutions and workflow optimization

- Large-scale hospital system partnerships

- Advanced IT and data management capabilities

Emerging Innovators

Ozelle Diagnostics (Silicon Valley-originated, Frankfurt-headquartered)

- Pioneering AI + Complete Blood Morphology (CBM) technology

- 50,000+ units deployed globally serving 40+ million patients

- Tiered product portfolio: EHBT-25 (compact entry-level), EHBT-50 (integrated multi-functional), EHBT-75 (premium 7-diff), EHVT-50/75 (veterinary)

- 500+ employees with 60%+ in R&D

- 500+ technology patents in AI diagnostics, optical systems, smart algorithms

- ISO 13485:2016 and CE-certified manufacturing

Emerging Regional Players

- Chinese manufacturers rapidly expanding in Asia-Pacific with cost-competitive offerings

- Indian companies developing point-of-care solutions for underserved markets

- European mid-market players focusing on niche applications (e.g., veterinary, coagulation studies)

Business Model Drivers: Why Wholesale Models Are Gaining Traction

Cost Efficiency

Advanced AI-powered analyzers eliminate expensive manual microscopy, reducing labor costs dramatically. Single-use disposable cartridges and maintenance-free designs lower operational expenses compared to legacy systems requiring ongoing calibration, cleaning solutions, and service interventions.

Example: Switching from a premium flow cytometry system ($100,000+ capital + $50,000+ annual service) to an integrated AI analyzer ($40,000 capital + minimal service costs) delivers 40–50% total cost of ownership reduction.

Operational Scalability

Wholesale models provide flexibility for organizations managing variable testing volumes. Compact systems suitable for point-of-care settings coexist with high-throughput instruments for centralized laboratories, enabling seamless scaling across multiple locations.

Rapid Turnaround Time Advantage

AI analyzers reducing turnaround time from hours to minutes accelerate clinical decision-making—particularly critical in emergency departments, surgical pre-op screening, and acute infection assessment. For wholesale providers offering networked systems, standardized rapid reporting dramatically improves patient throughput.

Technician Shortage Mitigation

Fully automated analyzers with intuitive interfaces enable non-specialist staff to operate systems reliably, directly addressing the global shortage of qualified laboratory technicians.

Regional Insights: Market Dynamics by Geography

North America (41% market share, 2024)

Strengths:

- Advanced healthcare ecosystem with high diagnostic volumes

- Strong presence of top-tier manufacturers (Beckman Coulter, Abbott, Sysmex)

- Robust reimbursement infrastructure supporting widespread screening

- Significant R&D investment in automated and AI-powered diagnostics

Trends:

- Consolidation of hospital laboratory services around centralized hubs

- Rapid adoption of AI-enabled quality control systems

- Growing POCT adoption in emergency departments and urgent care

Europe (Strong but Mature)

Strengths:

- Advanced healthcare infrastructure and diagnostic standards

- Regulatory frameworks (CE marking, ISO 13485) driving product innovation

- Professional societies promoting evidence-based diagnostics

Trends:

- Emphasis on laboratory automation and operational efficiency

- Integration of digital pathology for complex case review

- Focus on sustainability and waste reduction

Asia-Pacific (Fastest-growing, 8.2%+ CAGR)

Growth Drivers:

- Rapid healthcare infrastructure expansion

- Government investment in diagnostic capabilities

- Rising middle class demanding quality healthcare

- Lower cost-to-deploy models favored over enterprise systems

Key Markets:

- China: 7.2% CAGR, massive hospital laboratory modernization programs

- India: 6.7% CAGR, primary healthcare expansion, growing diagnostic lab network

- Southeast Asia: Thailand, Vietnam, Philippines—rapid urbanization and healthcare facility development

- Japan/South Korea: Mature markets with focus on advanced AI integration

Clinical Advantages: Beyond Simple Cell Counting

Comprehensive Morphological Assessment

Modern AI-powered analyzers provide pathological and morphological abnormality flags automatically. Rather than requiring manual slide review, systems identify:

- Immature cell populations: Neutrophilic stab granulocytes (NST), indicating bone marrow stress

- Abnormal cell morphology: Schistocytes, echinocytes, teardrop cells signaling hemolytic anemia or microangiopathy

- Reticulocyte identification: Immature RBCs with residual RNA, indicating bone marrow function

- Abnormal WBC detection: Early granulocytes, monocyte abnormalities, malignant cell flags

This depth of morphological analysis enables earlier disease detection and more informed clinical decision-making.

Integrated Multi-Parameter Testing

Rather than ordering separate tests across multiple instruments, integrated platforms enable intelligent tiered testing:

- Infection typing panels: CBC + CRP + SAA for rapid infection severity assessment

- Diabetes screening: CBC + HbA1c + glucose + lipids/triglycerides from single sample

- Cardiac risk panels: CBC + NT-proBNP for heart failure screening

- Kidney function: CBC + creatinine + urea + cystatin C for nephrology monitoring

Challenges and Barriers to Adoption

Capital Cost Barriers in Resource-Limited Settings

Advanced AI-powered analyzers with multi-parameter capability command USD 30,000–$80,000+ per unit pricing. While justified by operational efficiency and clinical value, adoption in low- and middle-income countries remains constrained by budget limitations.

Mitigation: Tiered product portfolios offering entry-level compact systems (EHBT-25 pricing <$20,000) alongside premium platforms (EHBT-50/75 at $40,000–$80,000) expand addressable markets.

Integration Complexity

Seamless integration with hospital information systems (HIS), laboratory information systems (LIS), and electronic health records (EHR) requires sophisticated software architecture. Legacy hospital IT infrastructure can create implementation challenges.

Trend: Cloud-based platforms and standardized HL7/FHIR integration protocols are simplifying connectivity.

Regulatory and Reimbursement Variability

Diagnostic test reimbursement rates vary dramatically across geographies and insurance models. Some emerging markets lack clear reimbursement pathways for advanced parameters (e.g., morphology interpretation, AI-assisted diagnoses).

Future Outlook: Market Evolution Through 2034

Phase 1: Consolidation & Standardization (2025–2027)

- Continued market consolidation among established players

- AI + CBM technology becoming industry standard rather than premium differentiation

- Regulatory clarity on AI-assisted diagnostics driving standardized approaches

Phase 2: Decentralization & Accessibility (2028–2031)

- Accelerated migration toward point-of-care and distributed diagnostics

- Compact, maintenance-free analyzers achieving hospital laboratory-equivalent accuracy

- Emerging market penetration intensifying as tiered pricing models expand access

Phase 3: Intelligent Integration & Predictive Analytics (2032–2034)

- AI algorithms advancing toward predictive disease detection

- Seamless integration of hematology, chemistry, immunoassay, molecular, and genomic data

- Real-time population health analytics enabling preventive intervention

- Telemedicine-integrated diagnostics becoming standard in resource-constrained regions

Conclusion: Positioning for Success in the Evolving Diagnostic Landscape

The blood test machine market represents far more than incremental technology improvement. It reflects a fundamental reimagining of how healthcare systems approach diagnostics—moving from centralized, labor-intensive, expertise-dependent processes toward distributed, automated, intelligent systems accessible to every healthcare setting globally.

For healthcare providers, the imperative is clear: advanced blood analyzers are no longer premium luxuries but essential infrastructure for delivering timely, accurate, equitable diagnostics. Organizations embracing intelligent, integrated, accessible blood analyzer technology position themselves advantageously in an increasingly competitive, value-conscious healthcare landscape.

For manufacturers and distributors, the opportunity lies in understanding market heterogeneity: a tiered product portfolio addressing entry-level point-of-care needs, mid-market integrated solutions, and premium multi-parameter platforms captures value across the entire diagnostic spectrum—from remote clinics to sophisticated tertiary care centers.

The projected growth from USD 4.33 billion (2025) to USD 7.28 billion (2034) is not temporary market enthusiasm—it reflects structural healthcare transformation driven by aging populations, rising chronic disease burden, diagnostic decentralization, and AI-powered innovation. This evolution presents both imperative and extraordinary opportunity for stakeholders across the diagnostic ecosystem.

About Ozelle: Leading the AI-Powered Diagnostic Revolution

Ozelle Diagnostics exemplifies the next generation of diagnostic innovation. Founded in Silicon Valley in 2014 and headquartered in Frankfurt, Germany since 2020, the company combines American innovation culture with German precision engineering to deliver AI-powered blood diagnostics globally.

Company Highlights:

- 50,000+ units deployed worldwide serving 40+ million patients annually

- 500+ employees with 60%+ dedicated to research and development

- 500+ technology patents in AI diagnostics, optical systems, and smart algorithms

- ISO 13485:2016 and CE-certified manufacturing

- Global R&D centers in Silicon Valley (USA), Frankfurt (Germany), and Shenzhen (China)

- Diversified product portfolio serving human medical, veterinary, and research applications

Ozelle’s Core Technology:

Complete Blood Morphology (CBM) combines traditional CBC parameters with advanced cell morphology analysis powered by deep learning algorithms trained on 40+ million patient samples. This fusion delivers expert-level diagnostic accuracy with minimal human intervention.