The hematology equipment market represents one of the most critical segments in laboratory diagnostics worldwide. As healthcare systems globally continue to prioritize diagnostic accuracy, operational efficiency, and cost containment, the selection of a reliable hematology equipment manufacturer has become increasingly strategic for distributors and importers. The global hematology analyzer market, valued at approximately USD 4.33 billion in 2025, is projected to reach USD 7.28 billion by 2034, expanding at a compound annual growth rate (CAGR) of 5.97% over this period. This explosive growth reflects fundamental shifts in healthcare delivery, diagnostic methodology, and the rising integration of artificial intelligence in clinical decision-making.

For distributors and importers entering this dynamic market, the strategic importance of selecting the right manufacturing partner cannot be overstated. A well-chosen manufacturer provides not only quality products but also comprehensive support for market expansion, regulatory compliance, and long-term business sustainability. This article addresses the critical challenge facing distribution businesses: how to effectively screen, evaluate, and establish long-term cooperative relationships with hematology equipment manufacturers that align with your market objectives and financial goals.

Understanding the Global Hematology Equipment Manufacturing Landscape

Key Manufacturing Regions and Their Advantages

The global hematology equipment manufacturing landscape is dominated by three primary regions, each offering distinct advantages and strategic value to potential distribution partners.

Germany: Precision Engineering and Premium Quality Standards

Germany represents the gold standard for precision manufacturing in medical diagnostics. German manufacturers are renowned for their engineering excellence, adherence to stringent quality standards, and commitment to innovation. Products manufactured in Germany command premium pricing but deliver superior reliability, durability, and technical sophistication. German manufacturers typically hold extensive patent portfolios in optical systems, automation technologies, and signal processing algorithms. For distributors targeting premium market segments—particularly in North America and Western Europe—German-manufactured equipment offers unmatched brand prestige and customer confidence. The investment in German manufacturing typically results in higher profit margins and stronger competitive positioning in developed markets.

USA: Technological Innovation and FDA Compliance Leadership

The United States leads in technological innovation and has the most extensive experience with FDA regulatory pathways. American manufacturers pioneered many advanced technologies in hematology analysis, including flow cytometry systems, automated quality control mechanisms, and early AI integration. U.S.-based manufacturers benefit from proximity to major research institutions, advanced capital markets, and sophisticated customer bases that drive continuous innovation. The American regulatory environment, while demanding, has created manufacturers with unparalleled expertise in navigating FDA 510(k) pathways and comprehensive quality management systems. For distributors serving the North American market or seeking manufacturers with proven FDA track records, U.S.-based partners provide optimal alignment with regional regulatory requirements.

China: Cost Advantages and Massive Production Capacity

China has emerged as the world’s manufacturing powerhouse for diagnostic equipment, including hematology analyzers. The region offers compelling advantages: significant cost advantages stemming from lower labor costs, massive production capacity capable of scaling from small pilot volumes to millions of units annually, and rapid delivery speeds that enable quick market entry. Chinese manufacturers have developed sophisticated supply chains for optical components, electronic systems, and reagent formulations. For distributors seeking entry-level or mid-market analyzers with competitive pricing, Chinese manufacturers provide excellent accessibility to production capacity and the ability to customize products for specific regional markets. However, quality consistency varies significantly among Chinese suppliers, necessitating rigorous quality verification processes.

Types of Hematology Equipment Manufacturers

Understanding the structural differences between manufacturer types is essential for aligning partnership models with your business objectives and market strategy.

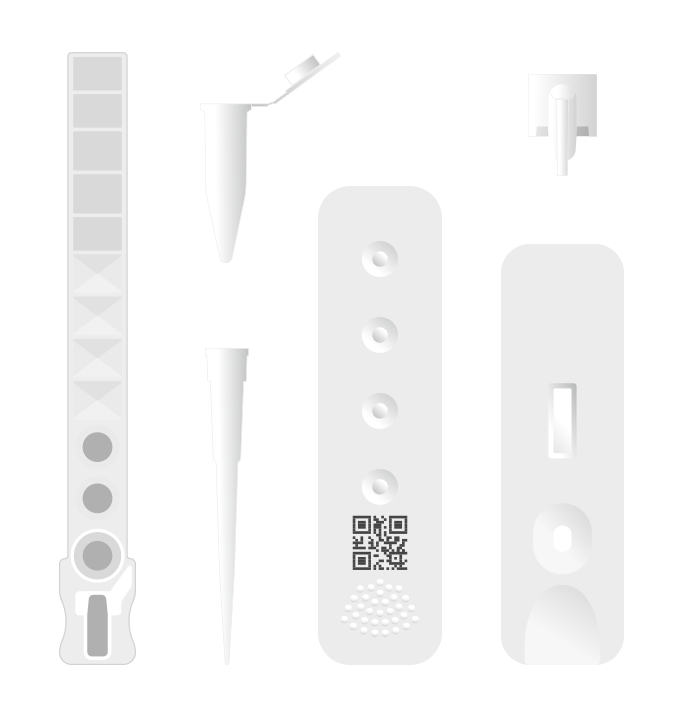

OEM Manufacturers: Factories Producing Equipment for Other Brands

OEM facilities produce hematology analyzers per partner specifications, focusing on manufacturing excellence and quality control without brand recognition. Products sell under partner brands. For distributors, OEM partnerships offer lower capital investment, faster market entry, and manufacturing expertise. They provide flexible minimum order quantities and customization options while distributors build independent brand equity.

ODM Manufacturers: Companies Providing Their Own Designs for Private Labeling

ODM companies develop proprietary product designs and technology platforms, offering private labeling to distribution partners. They handle research, prototyping, regulatory documentation, and clinical validation. Distributors benefit from reduced technical burden, sophisticated market-tested products, training support, and after-sales infrastructure. This model suits distributors lacking R&D capabilities but seeking branded product lines with resource efficiency.

Full-Service Manufacturers: Integrated Providers Offering Comprehensive Solutions

Full-service manufacturers like Ozelle provide end-to-end solutions including R&D, manufacturing, regulatory support, and branding services. They invest in proprietary technology, IoT platforms, and AI algorithms. They offer customizable portfolios from entry-level to premium analyzers. Distributors gain access to cutting-edge technology, comprehensive support, integrated ecosystems, and positioning for dominant market presence.

Comparison Table of Manufacturer Types

| Manufacturer Type | Design Ownership | Brand Strategy | Customization | Regulatory Support | Technical Training | After-Sales Service | Ideal For |

| OEM Manufacturers | Partner-designed | White label / private label | High | Partner responsibility | Limited | Partner responsibility | Distributors building brands quickly |

| ODM Manufacturers | Manufacturer-designed | Private labeling | Moderate to High | Shared responsibility | Comprehensive | Partial manufacturer support | Growing brands needing R&D support |

| Full-Service Manufacturers | Manufacturer-designed | Full brand support | High | Comprehensive | Extensive | Full-service integration | Market leaders seeking differentiation |

What Distributors and Importers Should Look for in a Hematology Equipment Manufacturer

Product Portfolio and Technology Capabilities

Product Line Breadth and Scope

A manufacturer’s product portfolio breadth directly determines your ability to serve diverse market segments and customer requirements. Assess whether the manufacturer offers a complete spectrum of analyzers: 3-part differential analyzers for entry-level primary care settings, 5-part and 7-part analyzers for mid-range hospital applications, and integrated multi-functional platforms combining hematology with immunoassay and biochemistry for advanced diagnostic centers. Premium manufacturers like Ozelle offer this comprehensive range—EHBT-25 for primary care, EHBT-50 for integrated diagnostics, EHBT-75 for advanced hematology labs, and specialized EHVT-50 systems for veterinary applications. This portfolio breadth enables distributors to address the entire market spectrum without depending on multiple manufacturers, streamlining supply chain management and strengthening customer relationships through single-vendor convenience.

Technological Edge and Competitive Differentiation

Modern hematology equipment increasingly incorporates advanced technologies that significantly impact clinical outcomes and operational efficiency. Evaluate manufacturers’ technological capabilities in several critical areas: AI-powered morphological analysis using deep learning algorithms trained on millions of patient samples, digital workflow integration enabling seamless connection to laboratory information systems (LIS) and hospital information systems (HIS), and IoT connectivity enabling remote device monitoring, predictive maintenance, and cloud-based data management. Ozelle’s AI + Complete Blood Morphology (CBM) technology, trained on 40+ million patient samples and recognized at the 2022 WAIC, exemplifies the technological differentiation that drives market leadership. Advanced technological capabilities justify premium pricing, improve customer retention, and create sustainable competitive advantages in dynamic market environments.

Innovation and Iteration Speed

The speed at which manufacturers develop new products and implement technological improvements directly impacts your competitive positioning over time. Assess the manufacturer’s R&D investment levels (typically measured as a percentage of revenue), the number of active patents in their portfolio, the frequency of product updates and feature enhancements, and their track record of bringing innovative solutions to market. Manufacturers with strong innovation cultures typically dedicate 60%+ of their workforce to R&D activities. Rapid innovation cycles enable manufacturers to incorporate emerging technologies—such as advanced AI capabilities, improved optical systems, and novel reagent formulations—maintaining product differentiation and enabling price optimization as competitors lag in technological capabilities.

Quality Certifications and Regulatory Compliance

Essential Certifications and Regulatory Registrations

Quality certifications and regulatory approvals serve as objective markers of manufacturing standards and product reliability. Essential certifications include CE marking (indicating compliance with European medical device regulations and quality management standards), FDA 510(k) clearance or equivalent regulatory approval in target markets, and ISO 13485 certification demonstrating compliance with medical device quality management system standards. Ozelle holds CE, FDA, ISO 13485:2016, and CQC certifications, providing distributors with confidence in regulatory compliance across major markets. Additional certifications such as ISO 9001 (general quality management), GMP (Good Manufacturing Practice) compliance, and country-specific registrations strengthen positioning in particular markets. When evaluating manufacturers, request complete certification documentation and verify current status through relevant regulatory agencies.

Regional Registration Support and Local Compliance

Different markets require distinct regulatory registrations and compliance documentation. Comprehensive manufacturers provide active support for regional registration processes, including preparation of technical documentation, liaison with local regulatory authorities, and assistance with local language translations and market-specific requirements. This support significantly reduces the time and expense associated with market entry and mitigates regulatory risks that could delay product launches. Evaluate manufacturers’ experience in your target markets and their established relationships with regional regulatory bodies. Strong manufacturers maintain dedicated regulatory affairs teams with expertise in specific market requirements—this capability directly impacts your ability to expand into new geographies efficiently.

Quality Management Systems and Rigorous Testing Procedures

Beyond certifications, assess the manufacturer’s operational quality systems: documented procedures for design control, risk management, complaint handling, and corrective/preventive actions; regular third-party audits and surveillance activities; comprehensive traceability systems tracking components and finished products; and rigorous testing protocols including sterility, biocompatibility, and performance validation. Request access to recent audit reports from TÜV, SGS, or equivalent third-party certification bodies. Manufacturers with mature quality systems demonstrate lower field failure rates, reduced customer complaints, and superior long-term reliability—factors that directly impact your brand reputation and customer retention.

OEM/ODM Capabilities and Customization Options

Private Label and Branding Capabilities

For distributors seeking to establish independent brands, assess the manufacturer’s private labeling capabilities in detail. Comprehensive manufacturers like Ozelle offer complete branding support: custom exterior design incorporating your company colors, logos, and aesthetic preferences; customized packaging and documentation bearing your brand identity; option to develop product names and market positioning aligned with your brand strategy; and support for regulatory approvals under your brand designation. This capability enables distributors to establish distinct market presence while leveraging the manufacturer’s manufacturing excellence and R&D investment. Request information about minimum order quantities for branded products, lead times for customization, and associated costs for design modifications.

Software Interface Localization and Customization

Clinical equipment must function reliably across diverse language regions, healthcare systems, and operational workflows. Comprehensive manufacturers provide software customization services including user interface localization to regional languages, customization of report formats and data fields to align with local clinical practices and regulatory requirements, integration with existing laboratory information systems common in your target markets, and customization of quality control protocols and reference ranges to match regional standards. These capabilities ensure that imported equipment integrates seamlessly into existing healthcare workflows rather than requiring staff retraining on unfamiliar interfaces and workflows.

Flexible Minimum Order Quantities

ODM and full-service manufacturers increasingly recognize that rigid minimum order quantities (MOQs) exclude smaller distributors and limit business growth for emerging players. Evaluate manufacturers’ flexibility regarding MOQs, particularly for initial partnership phases when sales volumes remain uncertain. Progressive manufacturers offer tiered MOQ structures: lower minimums for trial/pilot phases, standard minimums for ongoing supply, and volume discounts as order quantities increase. This flexibility enables distributors to launch distribution operations with manageable capital investment and scale purchases as market demand develops, reducing financial risk during market development phases.

Supply Chain Reliability and Lead Times

Production Capacity and Delivery Guarantees

Manufacturing capacity directly impacts your ability to fulfill customer demand consistently and scale your business. Assess the manufacturer’s total monthly production capacity, current capacity utilization rates, and any constraints limiting production expansion. Request written commitment to guaranteed delivery lead times and understand any force majeure provisions or supply-side risks that could disrupt supply reliability. Manufacturers operating below full capacity typically offer superior delivery performance; those at or near capacity constraints risk fulfillment delays when demand spikes. Evaluate whether the manufacturer maintains safety stock buffers for critical models and whether they provide advance notice of planned maintenance or capacity constraints.

Inventory Management and Ready-to-Ship Capabilities

Distribution velocity—the speed at which products move from manufacturer inventory to customer delivery—significantly impacts your working capital requirements and competitive responsiveness. Assess whether manufacturers maintain regional distribution centers or warehousing capacity enabling rapid order fulfillment, offer “ready-to-ship” inventory for standard models, and provide inventory tracking systems enabling real-time visibility into stock availability. Some manufacturers maintain finished goods inventory at regional distribution hubs, enabling 24-48 hour delivery to distributors rather than 4-8 week manufacturing-to-delivery cycles. This capability enhances your responsiveness to customer demand and reduces capital tied up in inventory.

Logistics Coordination and Freight Optimization

International distribution of hematology equipment involves complex logistics coordination including sea freight, air freight, customs clearance, and last-mile delivery. Comprehensive manufacturers provide logistics support including freight negotiation leveraging their volume economies, experience with customs documentation and regulatory requirements for medical device shipments, and support for DDP (Delivered Duty Paid) terms simplifying your import process. Request information about the manufacturer’s freight partnerships, average lead times for sea and air shipment to your target markets, and any regional warehousing capabilities. Strong manufacturers have optimized their logistics networks over years of international distribution, providing capabilities that smaller distributors would struggle to replicate independently.

Evaluating Business Partnership Models with Hematology Equipment Manufacturers

Exclusive vs. Non-Exclusive Distribution Agreements

Exclusive Distribution Rights and Market Protection

Exclusive distribution arrangements grant a single distributor exclusive rights to sell manufacturer products within defined geographic territories. Exclusivity provides significant competitive advantages: protected market territory preventing competing distributors from selling the same products in your region, stronger customer relationships as you become the sole source for the manufacturer’s products, and enhanced negotiating leverage with customers due to exclusive availability. Exclusive arrangements typically require distributors to commit to minimum sales targets, maintain customer service standards, and invest in market development and technical training. Evaluate whether the proposed exclusivity terms align with realistic market penetration rates in your target geography and whether you possess adequate resources to fulfill minimum sales obligations.

Non-Exclusive Cooperation and Market Flexibility

Non-exclusive arrangements permit the manufacturer to work with multiple distributors in overlapping geographic territories. While non-exclusive models eliminate market protection, they offer significant advantages: lower commitment requirements and reduced financial risk during partnership establishment phases, flexibility to represent competing products for market diversification, and elimination of penalty clauses if you fail to achieve sales targets. Non-exclusive models suit distributors seeking to test market demand before committing to exclusive arrangements, those representing products across multiple manufacturers, or those targeting smaller, fragmented markets where geographic exclusivity becomes impractical. Many progressive manufacturers employ non-exclusive models initially, converting successful partnerships to exclusive arrangements as sales volumes and market commitment demonstrate alignment.

ODM Partnership: Building Your Own Brand

The ODM Cooperation Workflow and Process

ODM partnerships typically follow a structured workflow: initial market assessment and feasibility analysis, product selection or customization planning, sample development and testing, regulatory documentation and approval processes, manufacturing scale-up and quality validation, market launch with marketing support, and ongoing product optimization. The complete ODM process typically requires 6-12 months from initial engagement to market launch, depending on the extent of customization required and regulatory approval timelines. Ozelle’s comprehensive ODM support includes market analysis, product customization, regulatory guidance, technical training, and ongoing customer support infrastructure. Evaluate the manufacturer’s project management capabilities, ability to meet development timelines, and flexibility to accommodate your specific market requirements.

Brand Building Support and Marketing Collaboration

Comprehensive manufacturers provide extensive brand building support including development of marketing materials (brochures, technical specifications, case studies), provision of product samples for clinical evaluation and demonstration, training for your sales and technical teams, support for market launch events and clinical education programs, and ongoing technical education resources for your customer base. This support significantly accelerates brand establishment and market acceptance. Request detailed information about the manufacturer’s marketing support capabilities, availability of co-branded marketing materials, and the extent of manufacturer participation in your market launch activities.

Case Study: Building Regional Dominance Through White-Label Products

Leading diagnostic distributors have established regional market dominance by partnering with comprehensive manufacturers for customized white-label products. These distributors typically differentiated themselves through superior customer service, localized clinical support, and market-specific product customization rather than proprietary technology development. By leveraging manufacturer R&D investment while building independent brand identity, these distributors achieved gross profit margins of 45-60% in competitive markets. Their success required strong market understanding, commitment to customer success, and willingness to invest in technical training and clinical education. For distributors with established customer relationships or targeted geographic markets, this model provides a rapid path to profitable market leadership.

Profit Margins and Pricing Structures

Understanding Pricing Models and Terms of Sale

Different pricing models create distinct financial outcomes and operational implications. Common pricing structures include: FOB (Free On Board) pricing where you assume shipping costs and risks from the factory, CIF (Cost, Insurance, and Freight) pricing where manufacturers include shipping and insurance in the quoted price, and DDP (Delivered Duty Paid) pricing where manufacturers handle all logistics, customs clearance, and duties. FOB pricing provides lower base unit costs but requires you to manage logistics complexity and costs. CIF pricing offers moderate simplification with predetermined shipping costs. DDP pricing maximizes simplicity, particularly for distributors lacking international logistics expertise, though it typically includes premium markups covering manufacturer logistics risks. Evaluate which pricing structure aligns with your logistics capabilities and working capital position.

How to Vet and Select the Right Manufacturing Partner

Essential Questions to Ask Potential Manufacturers

Asking the right questions during manufacturer evaluation prevents costly misalignments and ensures partnership viability. The following represents a comprehensive vetting checklist covering critical partnership dimensions:

Production and Supply Capacity

- What is your annual production capacity for hematology analyzers, and what percentage of current capacity is currently utilized?

- What are typical lead times for standard orders, and how do these vary by product model and order volume?

- Do you maintain regional distribution centers or finished goods inventory enabling faster order fulfillment?

- What is your historical on-time delivery performance rate?

- How do you manage supply disruptions or unexpected demand spikes?

Customization and Support

- Do you support small-batch trial orders or pilot programs to validate market fit before larger commitments?

- What customization options are available for branding, software interfaces, and packaging?

- What lead times and costs are associated with custom branding or software modifications?

- How is after-sales service and technical support structured—directly by your organization or through authorized service partners?

- What training and technical education resources do you provide for distributor sales and technical teams?

Quality and Certifications

- What quality certifications (CE, FDA, ISO 13485, country-specific registrations) does your company maintain?

- Can you provide recent third-party audit reports from TÜV, SGC, or equivalent certification bodies?

- What is your field failure rate, warranty coverage terms, and customer complaint resolution process?

- Do you conduct clinical validation studies and can you provide published performance data?

Regulatory and Compliance

- What regulatory support do you provide for market entry in specific target countries?

- Can you assist with local language translations and market-specific documentation?

- What experience do you have with FDA regulatory pathways and 510(k) processes?

- How do you handle post-market surveillance and regulatory compliance over product lifecycle?

Partnership Terms

- What is your minimum order quantity (MOQ) policy, and do you offer flexibility for initial pilot phases?

- Do you offer exclusive or non-exclusive distribution arrangements, and what are the associated terms?

- What marketing support and co-branding resources do you provide to distribution partners?

- How is pricing structured, and what volume-based discount schedules are available?

Factory Audits and Quality Verification

Remote vs. On-Site Facility Assessment

Factory audits provide critical visibility into manufacturing quality and supply reliability. Two audit approaches serve different purposes: remote audits using video tours, virtual meetings, and document review provide quick preliminary assessment with minimal travel costs but limited direct inspection capability; on-site audits enable comprehensive facilities inspection, observation of actual manufacturing processes, evaluation of quality systems and documentation, and direct conversation with quality and production leadership. For new partnerships, on-site audits are strongly recommended despite higher travel costs and time investment. On-site visits create relationship foundations, enable assessment of organizational culture and commitment to quality, and identify potential concerns that virtual assessment might miss.

Third-Party Verification and Audit Report Review

Supplementing your direct audit with third-party verification provides independent validation of manufacturing standards. Request recent inspection reports from internationally recognized certification bodies such as TÜV (German certification authority), SGS (global certification and testing), and equivalent regional authorities. These reports typically assess quality management systems, manufacturing practices, documentation completeness, and compliance with relevant standards. Review reports for any non-conformances, open corrective action items, or limitations on certification scope. Certification bodies typically maintain searchable registries enabling verification of active certifications and audit history.

Prototype Testing and Clinical Validation

Before committing to significant purchase volumes, obtain sample machines for comprehensive testing. Clinical validation activities should include: performance validation comparing analyzer results to reference laboratory methods using diverse patient samples, accuracy assessment for different patient populations (pediatric, geriatric, disease-specific samples), throughput and workflow testing under realistic operational conditions, and reliability assessment over extended operating periods. Ideally, arrange for clinical evaluation at respected reference laboratories or academic medical centers where independent validation strengthens confidence in manufacturer claims. Published clinical studies or peer-reviewed validation data provide particularly strong evidence of analytical performance.

Why Partner with Ozelle as Your Hematology Equipment Manufacturer

German Engineering, Global Reach

Origins, Company Heritage, and Commitment to Innovation

Ozelle represents a unique manufacturing partnership combining Silicon Valley innovation origins with dedicated R&D center operations in Germany. Founded in 2014, the company emerged from a diagnostic laboratory in Silicon Valley focused on applying artificial intelligence and IoT technologies to medical diagnostics. The combination of Silicon Valley innovation culture with German engineering precision created a distinctive competitive advantage: advanced technology development coupled with manufacturing excellence and quality discipline. Ozelle’s global operations include 8,700+ square meters of R&D and manufacturing facilities, 500+ employees with 60%+ dedicated to R&D activities, and operations spanning multiple continents. This structure enables continuous innovation while maintaining manufacturing quality comparable to established German diagnostics companies.

Extensive Global Distribution Network Coverage

Ozelle has established presence across diverse geographies, serving over 50,000 units installed globally supporting 40+ million patient samples across multiple continents. This global footprint demonstrates manufacturing scalability, regulatory compliance across diverse markets, and ability to support international distributor networks. Ozelle’s established presence in North America, Europe, Asia-Pacific, and emerging markets provides experienced guidance for new distribution partners entering unfamiliar markets.

Comprehensive Product Line for Human and Veterinary Use

Human Diagnostics Portfolio

Ozelle’s human diagnostics portfolio spans the complete market spectrum: EHBT-25 (3-part differential analyzer for primary care), EHBT-50 (integrated 7-part hematology with immunoassay and biochemistry), and EHBT-75 (advanced 7-part differential analyzer for reference laboratories). This portfolio breadth enables distributors to address diverse customer segments from primary care clinics through advanced hospital laboratories. Each analyzer incorporates Ozelle’s proprietary AI + Complete Blood Morphology (CBM) technology trained on 40+ million patient samples, delivering expert-level diagnostic capabilities previously requiring pathologist review.

Veterinary Diagnostics Integration

The EHVT-50 multi-functional veterinary analyzer represents specialized capability addressing rapidly expanding veterinary diagnostics market. The global veterinary diagnostics market was valued at over USD 3 billion in 2024 and is projected to reach USD 2.3 billion by 2030, growing at 9.3% CAGR—outpacing human diagnostics market growth. Ozelle’s veterinary platform enables distributors to serve the veterinary market segment, providing market diversification and additional revenue streams from specialized practitioners.

Integrated “Mini Lab” Solution for Comprehensive Testing

The EHBT-50 Mini Lab represents the market’s most comprehensive integrated testing platform, combining 7-part differential hematology, immunofluorescence assays (cardiac markers, inflammatory proteins, infectious disease serology), dry chemistry biochemistry, and urine/fecal analysis. This integration enables single-instrument replacement of 3-5 separate specialized analyzers, reducing laboratory footprint by 40-60%, simplifying maintenance, and improving operational efficiency. For distributors targeting hospitals and diagnostic laboratories seeking to consolidate equipment portfolios, the EHBT-50 represents a compelling value proposition.

Flexible Partnership Programs and Comprehensive Support

Full ODM Customization Services

Ozelle provides comprehensive customization capabilities enabling distributors to establish independent brands while leveraging proprietary technology. Services include custom exterior design incorporating distributor branding, software interface localization to regional languages and healthcare systems, customized reporting formats aligned with local clinical practices, and flexible minimum order quantities enabling partnership initiation with manageable capital requirements.

Global Distributor Recruitment Program

Recognizing the strategic importance of strong distribution partnerships, Ozelle has established structured distributor recruitment and support programs. These include market opportunity assessment, tiered partnership models (non-exclusive trial to exclusive long-term arrangements), comprehensive technical training for sales and technical teams, marketing support and co-branded materials, and ongoing business development guidance. This structured approach significantly reduces barriers for new distributors entering markets, particularly those entering unfamiliar geographies for the first time.

Comprehensive Marketing Support and Technical Training

Ozelle provides extensive marketing support including clinical education materials, case studies demonstrating real-world performance, technical webinars and training sessions, participation in industry conferences and trade shows, and ongoing content development for digital marketing channels. Technical training covers product operation, troubleshooting procedures, quality control protocols, and clinical interpretation of results. This support significantly accelerates distributor market launch and customer education, reducing the burden on distributors to develop content independently.

AI-Powered Technology Advantage

Morphological AI-Assisted Recognition

Ozelle’s proprietary AI + CBM technology distinguishes the company’s analyzers from competitors relying exclusively on flow cytometry or impedance counting. The technology combines: advanced optical imaging at 4-micron resolution capturing detailed cellular morphology, deep learning algorithms trained on 40+ million patient samples enabling detection of subtle pathological findings, automated identification of immature and abnormal cells (NST, NSG, NSH, RET, ALY, PAg), and continuous learning algorithms improving accuracy with each analyzed sample. This technology enables primary care clinics and smaller laboratories to achieve pathologist-level diagnostic sophistication previously available only at major academic medical centers.

IoT Cloud-Based Data Management

Ozelle’s Smart IoT Platform provides comprehensive device management and data analytics capabilities: centralized backend system managing device inventory, consumable tracking, and quality control across distributed analyzer networks; cloud-based data repository enabling remote monitoring of device performance, predictive maintenance algorithms identifying potential failures before they impact operations; and business intelligence tools providing analytics on testing patterns, reagent consumption, and operational efficiency. This platform creates recurring value beyond the initial equipment sale, enabling ongoing optimization of laboratory operations and identification of efficiency improvement opportunities.

Seamless HIS/LIS System Integration

Modern healthcare facilities increasingly require seamless data integration between diagnostic equipment and hospital/laboratory information systems. Ozelle analyzers support direct LIS/HIS integration through standard protocols (ASTM, HL7), enabling automatic result transmission without manual data entry, reducing transcription errors, and accelerating result availability to clinicians. This integration significantly improves laboratory workflow efficiency and patient care delivery by enabling rapid decision-making based on test results.

Next Steps: How to Start a Partnership with a Hematology Equipment Manufacturer

Request Product Samples and Pricing

The initial partnership phase involves evaluation of product performance, financial viability, and market fit. Request sample or demonstration units of the specific analyzer models under consideration. Comprehensive manufacturers typically facilitate sample access through structured trial programs specifying evaluation duration (typically 30-60 days), terms of use, performance metrics to be assessed, and clear pathway for purchase conversion if performance meets expectations. During sample evaluation, conduct thorough clinical validation comparing analyzer performance to reference methods using diverse patient samples, assess user interface usability and workflow integration, evaluate after-sales support responsiveness, and identify any operational challenges requiring resolution before market launch.

Simultaneously, request detailed pricing information including: unit costs at different order volumes and tiered pricing schedules; freight costs or DDP pricing terms; pricing structures for customized branding or software modifications; and information on rebate schedules or volume-based incentives. Develop financial models assessing gross margins at realistic selling prices in your target markets, payback periods for equipment investment, and operational cost structure to establish pricing strategy ensuring sustainable profitability.

Schedule a Factory Tour or Virtual Meeting

Direct engagement with manufacturer leadership and facilities provides invaluable insight into manufacturing capabilities, quality culture, and partnership potential. Arranging either an on-site factory tour (where feasible) or comprehensive virtual meeting enables: observation of manufacturing processes and quality control procedures, direct conversation with quality, production, and R&D leadership, assessment of organizational capacity and commitment to your partnership, and identification of any concerns or limitations affecting partnership viability. During these meetings, present your business strategy, market plans, and distribution capabilities, enabling the manufacturer to assess partnership fit and potential for mutual success.

Discuss Your Market and Business Goals

The most successful partnerships align manufacturer capabilities with distributor business objectives. During advanced discussions, clearly articulate your market strategy including: geographic focus and target customer segments, sales volume projections and timeline, service capabilities and distribution infrastructure, technical training and customer support capabilities, and financial investment capacity. Comprehensive manufacturers can provide market analysis for your target regions, identify market opportunities and competitive dynamics, assess price sensitivity and customer requirements, and propose customization or product modifications optimizing market fit. This collaborative approach ensures partnership alignment around shared objectives and realistic mutual expectations.

Conclusion

The hematology equipment market represents a substantial and expanding opportunity for distribution businesses possessing the strategic insight to select optimal manufacturing partnerships. As the market grows from USD 4.33 billion in 2025 to USD 7.28 billion by 2034, distributors partnering with innovative, quality-focused manufacturers like Ozelle will achieve sustainable competitive advantage through superior technology, comprehensive customer support, and reliable supply chains. The selection of a manufacturing partner requires systematic evaluation of production capabilities, technology sophistication, quality systems, and partnership support infrastructure. Distributors implementing the evaluation framework outlined in this guide—assessing manufacturer regions and types, evaluating product portfolios and customization capabilities, conducting thorough factory audits, and aligning partnership models with business objectives—position themselves for profitable market leadership.

Ready to grow your medical device distribution business? Contact Ozelle today to explore partnership opportunities and request your customized ODM or distribution proposal.