Hematology analyzers are evolving at an unprecedented pace—from impedance-only counters to AI-driven, all-in-one diagnostic platforms that reshape how laboratories operate worldwide. The global hematology analyzer market, valued at approximately 4.33 billion USD in 2025, is projected to reach 7.28 billion USD by 2034, expanding at a compound annual growth rate (CAGR) of 5.97% over this period. This rapid transformation reflects fundamental shifts in healthcare delivery, diagnostic methodology, and the rise of artificial intelligence in clinical decision-making.

This article reviews the global market landscape, leading manufacturers, and emerging innovations—and how new-generation companies like Ozelle reshape expectations for accuracy, integration, and accessibility across mid-market and entry-level segments, including specialized markets like veterinary diagnostics.

Global Market Landscape

The hematology analyzer market has undergone radical transformation over the past decade, driven by technological innovation, rising disease prevalence, aging populations, and the global shift toward decentralized, point-of-care testing. North America remains the dominant market region, capturing approximately 41% of total market share in 2024, supported by advanced healthcare infrastructure, regulatory sophistication, and high adoption rates of premium diagnostic systems. However, the most dramatic growth is occurring in Asia-Pacific, where emerging economies like China, India, and Southeast Asia are investing heavily in healthcare infrastructure and diagnostic capabilities.

The market is segmented across multiple dimensions: by technology type (flow cytometry, impedance, AI-powered morphology), by product tier (high-end, mid-range, entry-level), by end-user (hospitals, commercial laboratories, clinics, veterinary practices), and by geography. This multifaceted segmentation reflects the market’s maturity and the diverse needs of healthcare facilities ranging from major teaching hospitals to rural primary care clinics.

Key market barriers include high equipment costs, regulatory compliance complexity, and the need for skilled technical personnel. However, emerging opportunities are being created by decentralized diagnostic trends, cost-sensitive emerging markets, and the integration of artificial intelligence—which enables easier operation and more sophisticated analysis without requiring experienced pathologists.

Market Segments & What Each Buyer Group Needs

Premium Segment (Large Hospitals)

Large tertiary care hospitals and reference laboratories require high-throughput analyzers capable of processing 200+ samples daily with comprehensive multi-parameter analysis. Leading manufacturers like Sysmex and Beckman Coulter dominate this segment, offering sophisticated systems with advanced differential capabilities, hemostasis testing, and extensive quality control features. These institutions prioritize clinical comprehensiveness and research capabilities, justifying premium pricing ($80,000–$150,000+).

Mid-Market Segment (Regional Hospitals, Private Laboratories)

Mid-sized healthcare systems need balanced solutionssolutions, offering solid diagnostic capabilities with reasonable throughput (60–150 samples/day) and operational flexibility. This segment values multi-functional integration—the ability to consolidate hematology, immunoassay, and biochemistry testing on unified platforms—to optimize laboratory space and staffing efficiency.

Entry-Level Segment (Clinics, General Practitioners, Pharmacies, Decentralized Care)

Small clinics, family medicine practices, and pharmacy-based testing centers require compact, affordable, and easy-to-operate systems requiring minimal training. This segment prioritizes rapid turnaround times, low maintenance burden, and point-of-care capabilities that deliver lab-quality results in 6–10 minutes.

Specialized Markets (Veterinary, POCT)

Veterinary clinics and mobile diagnostic units require analyzers adapted for animal blood samples with species-specific reference ranges, rapid results, and portability. The veterinary point-of-care hematology diagnostics market alone was valued at 1.3 billion USD in 2024 and is projected to reach 2.3 billion USD by 2030, growing at a 9.3% CAGR—outpacing the human diagnostics market growth rate.

Ozelle’s Market Positioning: Ozelle is uniquely positioned to serve both mid-market and entry-level customer segments, especially those seeking multi-functional testing in a compact footprint with advanced AI-powered analysis. The company’s integrated analyzers address the mid-market need for operational consolidation while offering entry-level clinics access to expert-level diagnostics previously available only to major hospitals. Additionally, Ozelle serves specialized markets including veterinary diagnostics through its EHVT-50 platform.

Leading Hematology Analyzer Companies

Sysmex Corporation

Sysmex, headquartered in Japan, is one of the global market leaders in hematology analysis, commanding significant market share through its comprehensive product portfolio and advanced technology platforms like the XN-series analyzers. The company excels in high-volume hospital environments and has established strong brand recognition globally.

Beckman Coulter

Beckman Coulter, part of Danaher Corporation, maintains a substantial market presence with its DxH series of hematology analyzers and integrated diagnostic systems. The company is known for impedance-based technology, high throughput capacity, and extensive clinical validation. Recent clinical trials demonstrated over 99% accuracy in multi-center studies.

Horiba Medical

Horiba Medical (France) specializes in hematology and hemostasis analyzers with growing integration of AI algorithms. The company’s recent initiatives, including collaboration with clinical researchers on AI-powered sepsis detection using hematology parameters, exemplify the industry shift toward intelligent diagnostics.

Roche Diagnostics

Roche Diagnostics offers integrated diagnostic solutions combining hematology with chemistry and immunoassay, targeting hospital laboratory consolidation. The company leverages its broader in vitro diagnostics portfolio for integrated workflow solutions.

Abbott Laboratories

Abbott provides comprehensive diagnostic solutions, including hematology analyzers as part of broader laboratory automation systems for large hospitals and reference centers.

Key Technology Trends Shaping Competition

Artificial Intelligence and Machine Learning Integration

The most transformative trend is the integration of artificial intelligence into hematology analyzers. Traditional systems counted cells using impedance or flow cytometry methods, delivering quantitative data (cell counts) but missing morphological insights critical for early disease detection. AI-powered systems now combine CBC data with advanced microscopic imaging and deep learning algorithms trained on millions of patient samples.

Ozelle exemplifies this innovation with its AI + Complete Blood Morphology (CBM) technology, trained on 40+ million patient samples and recognized at the 2022 World Artificial Intelligence Conference (WAIC). This approach enables:

- Detection of immature and abnormal cells (NST, NSG, NSH, RET, ALY) that traditional analyzers miss

- Automatic flagging of disease markers without requiring manual pathologist review

- 97%+ accuracy in cell classification, matching or exceeding expert manual analysis

- Continuous algorithm improvement through machine learning with each new sample analyzed

Integrated Multi-Functional Analyzers

The market is shifting from single-purpose instruments to unified diagnostic platforms integrating:

- 7-part differential hematology with morphology analysis

- Immunofluorescence assays for cardiac markers, inflammatory proteins, and infectious disease serology

- Dry-chemistry biochemistry for glucose, lipids, and organ function parameters

- Urine and fecal analysis

- Additional testing modalities as clinical demands evolve

This integration consolidates 3–5 separate instruments into compact systems, reducing laboratory footprint by 40–60%, simplifying maintenance workflows, and improving clinical turnaround times. Ozelle’s EHBT-50 exemplifies this trend, combining 80+ test parameters in a single device while maintaining maintenance-free operation and room-temperature storage.

Decentralized Testing and Point-of-Care Expansion

Point-of-care testing (POCT) is fundamentally reshaping diagnostic delivery. Rather than centralizing testing in reference laboratories (requiring 2–6 hours for results), decentralized models place analyzers in emergency departments, clinics, pharmacies, and even mobile diagnostic units. This enables:

- 6–10 minute turnaround times versus traditional laboratory delays of 2–6 hours

- Faster clinical decision-making, particularly critical in acute care settings

- Improved patient outcomes through earlier intervention in conditions like sepsis (where each hour delay increases mortality risk by 4–9%)

- Better resource utilization in underserved regions lacking centralized laboratory infrastructure

The point-of-care hematology diagnostics market was valued at 2.4 billion USD in 2023 and is projected to reach 3.6 billion USD by 2030, growing at 5.8% CAGR—faster than centralized laboratory growth. Compact, maintenance-free analyzers like Ozelle’s EHBT-25 are driving this transformation by making sophisticated diagnostics accessible in settings previously limited to basic testing.

Expanded Parameter Reporting and Morphological Classification

Modern analyzers are moving beyond traditional 3-part and 5-part white blood cell differentials to include:

- 7-part differentiation with immature granulocyte detection

- Complete blood morphology identifying schistocytes, echinocytes, and other abnormal cell formations

- 37+ reportable parameters versus traditional 10–15 parameters

- Reticulocyte classification with maturation indices

- Platelet morphology assessment and clotting abnormality flags

This expanded reporting enables earlier disease detection and more precise clinical interpretation, particularly valuable in hematology-oncology, infectious disease, and critical care settings.

IoT Integration and Data Connectivity

Leading analyzers now feature seamless integration with laboratory information systems (LIS), hospital information systems (HIS), and cloud-based data platforms:

- Real-time quality assurance dashboards tracking analyzer performance and reagent consumption

- Predictive maintenance alerts reducing unplanned downtime

- Centralized reporting and consultation capabilities for remote expert review

- Data analytics identifying disease prevalence patterns and optimizing resource allocation

- Mobile app access enabling clinicians to review results and consult remotely

Ozelle’s smart IoT platform demonstrates this evolution, connecting devices across distributed locations into unified diagnostic ecosystems enabling real-time management, continuous algorithm improvement, and collaborative clinical consultation.

Where New-Generation Companies Fit: Ozelle’s Strategic Positioning

Market Differentiation and Technology Leadership

Ozelle occupies a distinctive market position as a new-generation diagnostics innovator combining three core advantages:

AI + Complete Blood Morphology Innovation

Unlike legacy manufacturers relying primarily on flow cytometry or impedance, Ozelle pioneered the integration of advanced machine vision, AI algorithms, and liquid-based cytology to deliver morphological analysis previously requiring expert pathologist review. This technology enables:

- Expert-level diagnosis from automated systems, democratizing access to sophisticated analysis

- Abnormal cell detection that traditional impedance-only analyzers fundamentally cannot achieve

- Continuous learning from 40+ million patient samples, improving accuracy with each sample analyzed

- Species adaptation enabling both human and veterinary applications from shared technological foundation

Integrated Multi-Functional Design

Rather than offering single-purpose hematology analyzers, Ozelle targets operational efficiency through consolidation. The EHBT-50 combines CBC analysis with immunoassay, dry-chemistry biochemistry, and urine/fecal testing—reducing equipment footprint, simplifying maintenance, and improving workflow efficiency for mid-market facilities.

Accessibility Through Affordable Innovation

Ozelle’s tiered product portfolio democratizes access to advanced diagnostics:

- EHBT-75: Professional-grade 7-diff analyzer for high-volume hospital laboratories (10 samples/hour)

- EHBT-50: Mid-tier multi-functional platform consolidating multiple testing modalities

- EHVT-50 & EHVT-75: Specialized veterinary analyzers for animal diagnostics

This segmented approach enables healthcare facilities across all scales to access AI-powered, morphology-based analysis at price points aligned with their operational budgets.

Application Scenarios Where Ozelle Excels

Emergency Departments: EHBT-75 delivers 6-minute results for acute patient assessment, critical in trauma, sepsis, and acute infection evaluation where rapid turnaround directly impacts mortality outcomes.

Regional Hospitals and District Facilities: EHBT-50 consolidates multiple laboratory functions, reducing space requirements, staffing complexity, and total cost of ownership—ideal for resource-constrained healthcare systems serving mid-sized populations.

Veterinary Practice: EHVT-50 provides comprehensive hematology, urine, fecal, and immunoassay analysis for companion and production animals, addressing the rapidly expanding veterinary diagnostics market.

Emerging Market Expansion: Ozelle’s focus on emerging markets (evidenced by recent product launches in Indonesia, Southeast Asia, and Latin America) aligns with global healthcare infrastructure expansion where decentralized diagnostic capacity directly addresses unmet diagnostic needs.

Competitive Advantages vs. Legacy Manufacturers

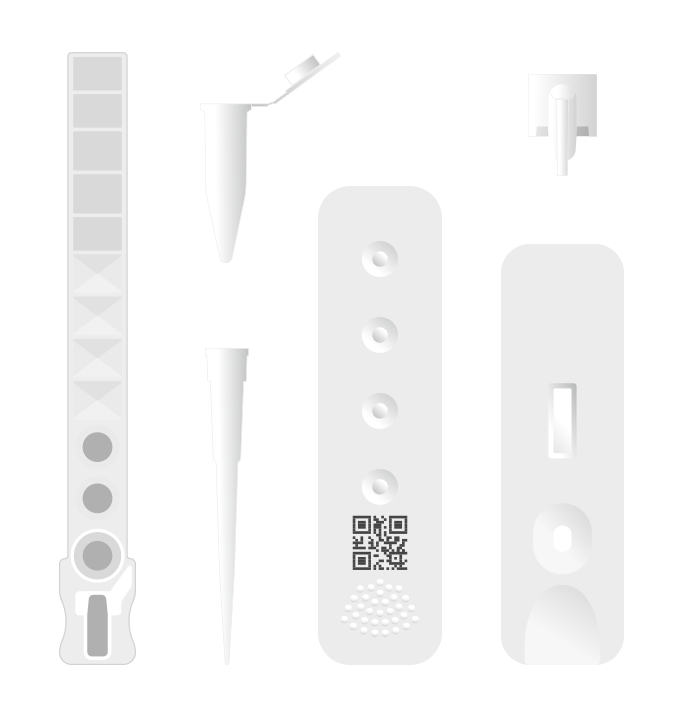

Cost of Ownership: Maintenance-free operation with single-use cartridges stored at room temperature eliminates recurring service costs, calibration burdens, and reagent waste inherent in traditional systems. Total cost of ownership typically justifies 12–24 month payback periods for consolidating multiple instruments.

Turnaround Time: 6-minute results versus 30–60 minute turnaround from traditional flow cytometry or 2+ hour centralized laboratory delays.

Operator Simplicity: AI-powered automation and intuitive touchscreen interfaces enable non-specialist staff to operate systems reliably, addressing global shortages of trained laboratory technicians.

Clinical Comprehensiveness: Morphology-based analysis combined with multi-functional testing capabilities deliver deeper clinical insights than single-modality analyzers can provide.

Global Scalability: 50,000+ units installed serving 40+ million patients worldwide demonstrates proven technology-market fit and operational scalability across diverse geographies and healthcare settings.

Conclusion

The hematology analyzer market stands at an inflection point where artificial intelligence, integrated diagnostics, and point-of-care expansion are fundamentally reshaping clinical laboratory practice. Legacy manufacturers built on flow cytometry and impedance technologies remain strong in premium hospital segments, but market leadership is fragmenting as new-generation innovators address unmet needs in mid-market efficiency, emerging market accessibility, and veterinary applications.

Ozelle exemplifies this new-generation approach—combining proprietary AI + Complete Blood Morphology technology with integrated multi-functional design, accessibility-focused product tiering, and genuine global scale (50,000+ units serving 40+ million patients). By targeting mid-market consolidation, entry-level clinic accessibility, and specialized veterinary applications simultaneously, Ozelle demonstrates that the future of hematology diagnostics belongs to companies solving real operational challenges while advancing clinical accuracy.

For healthcare organizations evaluating hematology analyzer strategies, the decision extends beyond selecting a single-purpose instrument to choosing a partner aligned with your facility’s specific needs—whether that means achieving operational consolidation efficiency, bringing advanced diagnostics to underserved communities, or expanding diagnostic scope without proportional increases in space and staffing.

The evolution from impedance-only counting to AI-driven complete blood morphology represents more than technological advancement—it represents democratization of expert-level diagnostics, enabling faster clinical decisions, earlier disease detection, and better patient outcomes across healthcare settings worldwide.

Explore how AI-powered hematology analysis can transform your diagnostic capabilities. Connect with diagnostic leaders reshaping global healthcare, from major hospitals to primary care clinics to veterinary practices—all discovering that the future of diagnostics is intelligent, integrated, and accessible.